Professional illustration about Mastercard

PayPal in 2025: Key Updates

PayPal in 2025: Key Updates

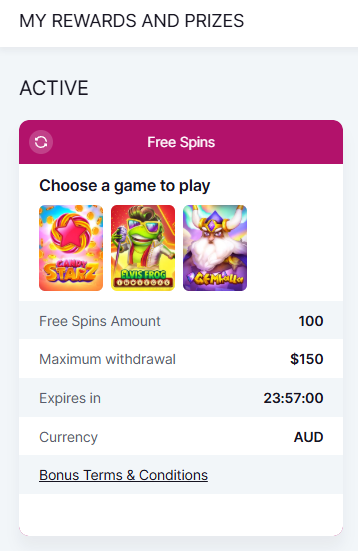

As one of the world’s leading digital wallet and payment processing platforms, PayPal has rolled out several major updates in 2025 to stay ahead in the competitive financial technology space. One of the most notable changes is the expansion of PayPal Savings, now offering a competitive APY through its partnership with Synchrony Bank. This high-yield savings feature, integrated directly into the PayPal mobile app, makes it easier for users to grow their funds while managing everyday transactions. Additionally, PayPal Inc has deepened its collaboration with Paxos Trust Company to enhance its cryptocurrency services, allowing seamless buying, selling, and holding of digital assets alongside traditional currencies.

For cardholders, the PayPal Cashback Mastercard and PayPal Credit Card have received upgrades, including higher cash back rewards and more flexible buy now pay later options. The PayPal Debit Card, linked directly to users’ balances, now supports instant transfers to Venmo, streamlining peer-to-peer payments. WebBank continues to underwrite PayPal’s credit products, ensuring smooth credit approval processes with real-time decisions. Meanwhile, Mastercard’s network ensures global acceptance, making PayPal’s cards a top choice for online checkout and in-store purchases.

Security remains a priority, with FDIC insurance now extending to eligible balances held in PayPal’s financial services, giving users added peace of mind. The platform has also introduced AI-driven fraud detection tools, reducing risks for both consumers and merchants. Another game-changer is PayPal’s revamped payment systems, which now support faster cross-border transactions with lower fees—ideal for freelancers and small businesses operating internationally.

For frequent shoppers, PayPal’s rewards ecosystem has been fine-tuned, offering personalized deals based on spending habits. The mobile app now features a unified dashboard, combining PayPal Savings, card management, and cryptocurrency tracking in one place. Whether you’re sending money, shopping online, or investing, PayPal’s 2025 updates solidify its position as a versatile financial service powerhouse.

Professional illustration about PayPal

How PayPal Works Today

In 2025, PayPal remains one of the most versatile financial technology platforms, seamlessly integrating payment processing, digital wallet services, and even cryptocurrency management. At its core, PayPal functions as a bridge between users and merchants, enabling secure transactions through its mobile app or online checkout system. When you link your bank account, PayPal Debit Card, or credit card (like the PayPal Cashback Mastercard), the platform acts as an intermediary—holding funds in your PayPal balance or processing payments directly from your linked sources. Notably, funds held in PayPal Savings, a high-yield account offered in partnership with Synchrony Bank, earn a competitive APY, while FDIC insurance via WebBank provides peace of mind for eligible deposits.

For shoppers, PayPal’s buy now pay later feature (powered by PAYPAL INC) splits purchases into interest-free installments, subject to credit approval. Meanwhile, the PayPal Credit Card rewards users with cash back on eligible purchases, and the PayPal Debit Card offers instant access to your balance at millions of locations worldwide. Small businesses and freelancers rely on PayPal’s payment systems to accept invoices, while peer-to-peer transfers (including to Venmo users) happen in seconds. Behind the scenes, partnerships with Mastercard and Paxos Trust Company ensure smooth transactions, whether you’re paying for groceries or trading Bitcoin.

Here’s how a typical transaction flows:

1. Checkout: Select PayPal at an online store or scan a QR code in-person.

2. Authorization: Choose your funding source (balance, linked card, or PayPal Credit).

3. Processing: PayPal encrypts your data and completes the transfer, often bypassing the need to share your card details with the merchant.

4. Confirmation: You receive a receipt, and the merchant gets paid—usually within one business day.

For added flexibility, PayPal’s financial services now include crypto wallets, allowing users to buy, hold, and sell digital assets alongside traditional currencies. Whether you’re splitting rent with roommates via Venmo or earning rewards with the PayPal Cashback Mastercard, the platform’s 2025 ecosystem is designed for speed, security, and simplicity. Pro tip: Regularly review your linked payment methods and enable two-factor authentication to maximize safety in this ever-evolving financial technology landscape.

Professional illustration about Synchrony

PayPal Fees Explained

Understanding PayPal Fees in 2025: What You Need to Know

PayPal remains one of the most popular digital wallets and payment systems globally, but its fee structure can be confusing. Whether you're using PayPal Credit Card, PayPal Debit Card, or sending money via Venmo (owned by PAYPAL INC), fees vary depending on the transaction type. Here's a breakdown of the most common charges you'll encounter in 2025:

Standard Payment Processing Fees: For online purchases or invoices, PayPal typically charges 2.99% + $0.49 per transaction within the U.S. International payments jump to 4.99% + a fixed fee based on the currency. Small businesses should factor this into pricing, especially for low-margin products.

Instant Transfer Fees: Need cash fast? Transferring money from your PayPal balance to a linked bank account instantly costs 1.75% (up to $25). The free 1-3 day ACH transfer is still an option if you’re not in a hurry.

Cryptocurrency Transactions: PayPal expanded its financial technology services to include buying, selling, and holding crypto. Fees here are competitive—usually 1.5%-2% per trade—but watch for spread margins during volatile market conditions.

PayPal Cashback Mastercard & Credit Products: The PayPal Cashback Mastercard, issued by Synchrony Bank, offers 2-3% cash back but has a variable APR (currently 19.99%-28.99% in 2025). Late payments trigger a $40 fee, and cash advances cost 5% (min $10). Meanwhile, PayPal Credit (backed by WebBank) promotes "buy now, pay later" with interest-free periods, but missed payments incur up to $38 penalties.

PayPal Savings: This high-yield account, powered by Paxos Trust Company, offers a 4.25% APY as of 2025—no monthly fees, but withdrawals exceeding 6 per month may incur penalties under federal Regulation D.

FDIC Insurance Note: While PayPal isn’t a bank, funds in PayPal Savings and certain balances (like those held with Mastercard-branded debit cards) are FDIC-insured through partner banks, adding a layer of security.

Pro Tips to Minimize Fees

- Use PayPal’s mobile app to track fee changes; they occasionally run promotions with reduced rates.

- Opt for "Friends & Family" transfers (free for U.S. users with linked bank accounts) instead of "Goods & Services," which deducts 3.49% + $0.49.

- If you’re a frequent seller, consider PayPal’s merchant rates—volume discounts can drop processing fees below 2.5%.

By understanding these nuances, you’ll avoid surprises and maximize the value of PayPal’s financial services. Whether you’re shopping, saving, or sending money, a little fee savvy goes a long way.

Professional illustration about Venmo

PayPal Security Features

PayPal Security Features: How Your Money and Data Stay Protected in 2025

When it comes to digital wallet safety, PayPal sets the gold standard with its multi-layered security features. Whether you're using the PayPal mobile app for online checkout, managing your PayPal Savings account, or swiping your PayPal Cashback Mastercard, the platform leverages cutting-edge technology to keep your transactions and personal data secure. Here's a deep dive into how PAYPAL INC safeguards your financial life in 2025.

Bank-Level Encryption and Fraud Monitoring

Every transaction processed through PayPal is protected by end-to-end encryption, ensuring that your payment details are never exposed. The platform uses the same level of security as major banks, including FDIC-insured partners like Synchrony Bank (for PayPal Credit Card) and WebBank (for PayPal Debit Card). Real-time fraud monitoring scans for suspicious activity, such as unusual login attempts or large purchases, and will temporarily freeze accounts if red flags are detected. For example, if someone tries to use your PayPal Cashback Mastercard in a foreign country without prior notice, the system may block the transaction and alert you instantly.

Two-Factor Authentication (2FA) and Biometric Login

In 2025, PayPal has strengthened its login protocols with mandatory two-factor authentication for all new accounts. You can opt for SMS codes, authenticator apps, or biometric verification (like Face ID or fingerprint scanning) to add an extra layer of security. This is especially critical for users who store cryptocurrency or use buy now pay later services, as these features are prime targets for hackers. Even if someone steals your password, they won’t be able to access your account without the second verification step.

Purchase Protection and Dispute Resolution

One of PayPal's standout features is its Purchase Protection program, which covers eligible purchases if they’re not delivered, arrive damaged, or are significantly different from the seller’s description. For instance, if you buy a laptop through payment processing on PayPal and the seller never ships it, you can file a dispute within 180 days for a full refund. This policy applies to most transactions, including those made with Venmo (owned by PayPal) or linked Mastercard products.

FDIC Insurance and Partner Protections

While PayPal itself isn’t a bank, funds held in PayPal Savings or PayPal Balance are FDIC-insured up to $250,000 through partner institutions like Paxos Trust Company. This means your money is just as safe as it would be in a traditional savings account. Additionally, PayPal Credit Card users benefit from Synchrony Bank’s zero-liability policy, ensuring you won’t be held responsible for unauthorized charges.

Advanced Cryptocurrency Safeguards

For users trading or holding cryptocurrency through PayPal, the platform now offers cold storage for digital assets, keeping them offline and away from potential cyber threats. Combined with 24/7 transaction monitoring, this makes PayPal one of the most secure financial technology platforms for crypto enthusiasts.

Pro Tips for Maximizing PayPal Security

- Regularly update your PayPal mobile app to ensure you have the latest security patches.

- Never share your credit approval details or one-time passwords (OTPs) with anyone.

- Use a unique, strong password for your PayPal account—consider a password manager.

- Enable cash back alerts on your PayPal Cashback Mastercard to spot unauthorized transactions quickly.

By combining these robust security features with smart user habits, PayPal remains a trusted leader in payment systems for 2025 and beyond. Whether you're shopping online, sending money to friends via Venmo, or earning APY on savings, you can do it all with confidence.

Professional illustration about WebBank

PayPal vs Competitors

When comparing PayPal to its competitors in 2025, it’s clear that the financial technology giant has carved out a unique space in the digital wallet and payment processing landscape. While rivals like Venmo (owned by PAYPAL INC) focus heavily on peer-to-peer transactions, PayPal offers a broader suite of services, including PayPal Credit Card, PayPal Debit Card, and even PayPal Savings—a high-yield account with competitive APY rates. Unlike some competitors, PayPal also integrates seamlessly with Mastercard and other major payment networks, making it a versatile choice for online checkout and in-store purchases.

One area where PayPal stands out is its buy now pay later (BNPL) feature, which rivals traditional credit options. While other platforms require credit approval, PayPal’s BNPL service often provides instant decisions, making it more accessible. Additionally, the PayPal Cashback Mastercard, issued by Synchrony Bank, offers robust rewards, competing head-to-head with cards from banks like WebBank. However, PayPal isn’t without its drawbacks. For example, its cryptocurrency services, powered by Paxos Trust Company, are less comprehensive than dedicated crypto platforms, and its FDIC-insured savings accounts still lag behind some neobanks in terms of interest rates.

Here’s a breakdown of how PayPal stacks up against key competitors in 2025:

- Versatility: PayPal’s mobile app supports everything from shopping to savings, while apps like Venmo are more limited to social payments.

- Fees: PayPal’s payment systems are fee-heavy for merchants, whereas newer fintech players often undercut them with lower transaction costs.

- Innovation: While PayPal has expanded into financial services like savings and credit, it faces stiff competition from agile startups offering faster, more user-friendly experiences.

For users who prioritize convenience, PayPal’s all-in-one ecosystem is hard to beat. But if you’re looking for specialized services—like higher cash back rates or advanced crypto trading—you might find better options elsewhere. The key is to weigh PayPal’s strengths against your specific needs in 2025’s fast-evolving financial technology landscape.

Professional illustration about PayPal

PayPal Business Benefits

For businesses in 2025, PayPal remains a powerhouse in payment processing and financial technology, offering a suite of tools designed to streamline operations, boost revenue, and enhance customer satisfaction. One of the standout benefits is its digital wallet integration, which allows businesses to accept payments seamlessly across multiple platforms, including online checkout, in-person transactions via QR codes, and even through social media stores. With over 400 million active users globally, PayPal provides instant access to a massive customer base, reducing friction at the point of sale. For instance, the PayPal Cashback Mastercard and PayPal Credit Card (issued by Synchrony Bank and WebBank) enable businesses to offer flexible financing options like buy now pay later (BNPL), which can increase average order values by up to 30% according to recent industry data.

Another major advantage is PayPal’s payment systems security and compliance. Funds held in PayPal Savings are FDIC-insured through Paxos Trust Company, giving businesses peace of mind when managing cash reserves. The platform also supports cryptocurrency transactions, allowing forward-thinking businesses to tap into emerging markets. For small businesses, PayPal’s mobile app simplifies invoicing, payroll, and expense tracking, while features like PayPal Debit Card (linked to Mastercard) provide instant access to earnings with 1% cash back on eligible purchases.

PayPal’s partnerships with Venmo and other fintech platforms further expand its utility. For example, businesses can leverage Venmo’s social payment features to attract younger demographics, while PayPal’s APY-bearing savings accounts (currently offering competitive rates) help businesses grow idle funds. The platform’s credit approval process is notably faster than traditional banks, with decisions often rendered in minutes—a game-changer for startups needing quick capital. Plus, with robust fraud protection and chargeback management, PayPal reduces financial risks for merchants.

For e-commerce businesses, PayPal’s one-click checkout reduces cart abandonment rates, and its global currency conversion supports cross-border sales without hefty fees. The ability to issue refunds instantly and automate subscription billing (ideal for SaaS companies) adds another layer of operational efficiency. In short, whether you’re a solopreneur or a mid-sized enterprise, PayPal’s ecosystem of financial services—from cash back rewards to seamless integrations—makes it a must-have tool for scaling in 2025.

Professional illustration about Mastercard

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one digital wallet for seamless payment processing, money management, and even cryptocurrency transactions—all from your smartphone. As of 2025, the app has evolved into a powerhouse for financial technology, integrating services like PayPal Savings (with competitive APY rates), PayPal Credit Card rewards, and buy now pay later options. Whether you're splitting bills with Venmo (owned by PAYPAL INC) or earning cash back with the PayPal Cashback Mastercard, the app consolidates everything under one secure login.

Key Features You Should Know:

- FDIC-insured balances: Funds held in PayPal Savings or your PayPal Debit Card are protected through partner banks like Synchrony Bank and WebBank.

- One-tap checkout: Link your Mastercard or other cards to speed through online checkout on thousands of sites.

- Credit tools: Check your credit approval odds for PayPal Credit Card without a hard pull, and track spending in real time.

- Crypto and stablecoins: Partnering with Paxos Trust Company, PayPal lets you buy, sell, and hold cryptocurrencies directly in the app.

Pro Tips for Power Users:

1. Maximize rewards: Use the PayPal Cashback Mastercard for 3% back on PayPal purchases and 2% elsewhere—activate offers in the app’s "Deals" tab.

2. Automate savings: Set up recurring transfers to PayPal Savings to grow your balance with minimal effort.

3. Security first: Enable biometric login (fingerprint or face ID) and transaction alerts to monitor your payment systems for fraud.

Common Pitfalls to Avoid:

- Overlooking fees for instant transfers (opt for the free 1-3 day option if you’re not in a rush).

- Ignoring the app’s financial service integrations, like bill pay or subscription management, which can save time and money.

- Forgetting to update your linked cards or banks, which can delay refunds or payment processing.

The app’s design prioritizes simplicity, but diving into settings unlocks advanced features. For example, small-business owners can generate invoices, while frequent travelers benefit from no-foreign-transaction-fee cards like the PayPal Debit Card. With constant updates in 2025, the PayPal Mobile App remains a leader in financial technology by blending convenience with robust security.

PayPal International Transfers

PayPal International Transfers have become a cornerstone for global commerce, offering a seamless way to send and receive money across borders. As of 2025, PayPal continues to dominate the digital wallet space, leveraging partnerships with Mastercard and Synchrony Bank to enhance its payment processing capabilities. Whether you're a freelancer receiving payments from overseas clients or a small business owner paying international suppliers, PayPal's platform simplifies the process with competitive exchange rates and transparent fees. One standout feature is the ability to hold balances in multiple currencies, reducing the need for frequent conversions and saving users money in the long run.

For those who frequently make international transfers, PayPal's integration with Venmo (for U.S. users) and its mobile app streamlines the experience. You can initiate transfers in seconds, track transactions in real-time, and even set up recurring payments for regular obligations. The platform also supports cryptocurrency transactions, allowing users to convert Bitcoin or Ethereum into local currency for cross-border transfers—a game-changer for tech-savvy users. However, it's worth noting that PayPal's fees vary depending on the destination country and transfer method, so always review the latest fee structure before proceeding.

If you're looking to maximize value, consider linking your PayPal Credit Card or PayPal Debit Card to your account. These cards, issued by WebBank and PAYPAL INC, often come with perks like cash back rewards or waived fees for certain transactions. For example, the PayPal Cashback Mastercard offers 2% cash back on all purchases, which can offset some of the costs associated with international transfers. Additionally, PayPal's buy now pay later options (backed by Synchrony Bank) provide flexibility for larger purchases, though these are typically limited to domestic transactions.

Security is another area where PayPal excels. While PayPal Savings accounts (offered in partnership with Paxos Trust Company) are not FDIC-insured, the platform employs robust encryption and fraud detection systems to protect your funds. For peace of mind, enable two-factor authentication and regularly monitor your account activity, especially when dealing with high-value international transfers.

Here’s a pro tip: If you're a business owner, explore PayPal's payment systems for invoicing and online checkout. The platform supports over 25 currencies, and you can customize invoices to include detailed breakdowns of fees and exchange rates—a professional touch that builds trust with international clients. For personal use, PayPal’s financial technology tools like currency converters and transfer calculators help you plan transactions more effectively.

Finally, keep an eye on credit approval requirements if you're using PayPal's lending services for cross-border transactions. While the platform is lenient compared to traditional banks, your transfer limits and eligibility for features like PayPal Credit may depend on your account history and verification status. By staying informed and leveraging PayPal's suite of financial services, you can navigate international transfers with confidence in 2025.

PayPal Buyer Protection

PayPal Buyer Protection is one of the standout features that makes PayPal a trusted financial service for online shoppers in 2025. Whether you're using your PayPal Credit Card, PayPal Debit Card, or even the PayPal Cashback Mastercard, this program ensures you're covered if something goes wrong with your purchase. Here's how it works: If an item doesn’t arrive, isn’t as described, or is significantly different from the seller’s listing, PayPal may reimburse you for the full purchase price plus shipping costs—up to $20,000 per claim. This applies to eligible purchases made through PayPal’s payment processing system, including those funded by PayPal Savings or linked bank accounts.

To qualify, you must file a dispute within 180 days of payment, and the transaction must be marked as "Eligible" or "Partially Eligible" in your account. For example, if you buy a laptop using your PayPal digital wallet and the seller ships a box of rocks instead, Buyer Protection has your back. However, there are exceptions: Real estate, vehicles, and custom-made items typically aren’t covered, nor are transactions involving cryptocurrency or peer-to-peer payments through Venmo.

What sets PayPal apart is its seamless integration with major payment systems like Mastercard, which often adds an extra layer of security. For instance, if you use your PayPal Cashback Mastercard (issued by Synchrony Bank) for a purchase, you might also benefit from Mastercard’s Zero Liability Protection. Meanwhile, services like PayPal’s buy now pay later options or PayPal Credit Card (backed by WebBank) are also covered under the same policy, as long as the transaction goes through PayPal’s online checkout.

Here’s a pro tip: Always keep records of your transactions, including screenshots of the product description and communication with the seller. PayPal’s resolution team will ask for evidence, and thorough documentation speeds up the process. Another key detail? The program doesn’t require you to have a balance in your digital wallet—it covers eligible purchases regardless of the funding source.

For high-value items, consider combining PayPal Buyer Protection with a credit card’s purchase protection. For example, if you pay with your PayPal Credit Card, you could potentially file claims with both PayPal and the card issuer (WebBank or Synchrony Bank, depending on your card). Just remember that FDIC insurance doesn’t apply here—it’s for deposit accounts, not purchase disputes.

Finally, PayPal’s mobile app makes it easy to file and track claims. Navigate to the transaction in question, tap "Report a Problem," and follow the prompts. The app also sends push notifications for updates, so you’re always in the loop. Whether you’re a frequent online shopper or just dipping your toes into e-commerce, PayPal Buyer Protection is a must-understand feature for stress-free spending in 2025.

PayPal Seller Policies

PayPal Seller Policies are designed to create a secure and transparent marketplace for both businesses and customers. As one of the world's leading payment processing platforms, PAYPAL INC enforces strict guidelines to prevent fraud, disputes, and chargebacks while ensuring smooth online checkout experiences. Sellers must comply with these policies to avoid account limitations or suspensions. For instance, PayPal requires sellers to provide clear product descriptions, delivery timelines, and return policies. Failure to meet these standards can result in holds on funds or even permanent bans from the platform.

One critical aspect of PayPal Seller Policies revolves around payment systems and dispute resolution. If a buyer files a claim, PayPal acts as a mediator, reviewing evidence from both parties. Sellers should maintain detailed records, such as tracking numbers and communication logs, to strengthen their case. Additionally, PayPal's Buy Now Pay Later feature (powered by partners like WebBank) introduces unique considerations. Sellers receive full payment upfront, but they must still adhere to refund policies if customers cancel orders or return items. This ensures fairness while leveraging financial technology to boost sales.

For businesses using PayPal Debit Card or PayPal Credit Card, understanding fee structures is vital. PayPal charges transaction fees (typically 2.9% + $0.30 per sale), but high-volume sellers may qualify for discounted rates. Sellers can also integrate Venmo as a checkout option, expanding their reach to younger demographics. However, Venmo transactions are subject to the same PayPal Seller Policies, so businesses must stay compliant across all platforms.

Cryptocurrency transactions add another layer of complexity. Through partnerships with Paxos Trust Company, PayPal allows crypto payments, but sellers should note that these are irreversible once confirmed. Unlike traditional refunds, crypto disputes require extra vigilance. Similarly, PayPal Savings (offered via Synchrony Bank) and PayPal Cashback Mastercard (issued by Mastercard) provide financial tools for sellers, but they don’t exempt users from adhering to core policies.

To optimize operations, sellers should:

- Use PayPal’s mobile app for real-time sales tracking and dispute management.

- Clearly state return windows and restocking fees to minimize chargebacks.

- Avoid high-risk categories (e.g., adult content, gambling) that violate PayPal’s financial service terms.

- Monitor APY rates if storing funds in PayPal Savings to maximize idle capital.

By aligning with PayPal Seller Policies, businesses can build trust, reduce risks, and leverage the platform’s digital wallet ecosystem for growth. Whether you’re a small vendor or a large retailer, staying informed about policy updates (especially in 2025) ensures long-term success in the evolving payment processing landscape.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support in 2025: What You Need to Know

PayPal has solidified its position as a leader in financial technology by expanding its cryptocurrency services, making it easier than ever for users to buy, sell, and hold digital assets directly through its digital wallet. As of 2025, PayPal supports Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), allowing seamless transactions alongside traditional payment methods like the PayPal Credit Card, PayPal Debit Card, and PayPal Cashback Mastercard. This integration bridges the gap between conventional banking and the crypto economy, offering users a unified platform for managing both fiat and digital currencies.

One of the standout features is PayPal’s partnership with Paxos Trust Company, a regulated entity that ensures compliance and security for crypto transactions. Unlike some platforms that require external wallets, PayPal lets users store crypto directly in their accounts, simplifying the process for beginners. However, it’s important to note that cryptocurrencies held in PayPal are not FDIC-insured, unlike funds in PayPal Savings or linked bank accounts. For added flexibility, users can also spend crypto at checkout by converting it to fiat currency instantly—a feature that works seamlessly with Mastercard-powered PayPal cards.

Security remains a top priority. PayPal employs advanced encryption and fraud detection systems, similar to those used for its payment processing services. While the mobile app provides real-time crypto price tracking, PayPal doesn’t yet support transferring crypto to external wallets, which may limit advanced traders. For those interested in earning rewards, the PayPal Cashback Mastercard offers cash back on purchases, though crypto transactions don’t currently qualify.

Looking ahead, rumors suggest PayPal may introduce buy now, pay later options for crypto purchases or even stake assets to earn APY. For now, its crypto services cater primarily to casual investors and shoppers leveraging online checkout. Competitors like Venmo (owned by PAYPAL INC) offer similar features, but PayPal’s global reach and integration with Synchrony Bank and WebBank for credit services give it an edge. Whether you’re dipping your toes into crypto or using it for everyday spending, PayPal’s ecosystem provides a user-friendly gateway—just remember to factor in fees and credit approval requirements when linking cards or accounts.

PayPal Rewards Program

The PayPal Rewards Program is one of the most competitive cashback and perks systems in the financial technology space, designed to maximize value for users of PayPal Credit Card, PayPal Debit Card, and even the PayPal Cashback Mastercard. As of 2025, the program continues to evolve, offering tailored rewards for online purchases, in-store transactions, and even cryptocurrency buys through PAYPAL INC's platform. Whether you're a frequent shopper or a casual spender, understanding how to leverage these rewards can significantly boost your savings.

One of the standout features is the cash back structure, which offers up to 3% back on eligible purchases when using the PayPal Cashback Mastercard, issued by Synchrony Bank. Unlike many competitors, there’s no annual fee, and rewards are automatically deposited into your digital wallet, making redemption seamless. For users who prefer buy now pay later options, the PayPal Credit Card (issued by WebBank) also integrates rewards, often featuring limited-time bonuses at major retailers.

Beyond cards, the PayPal Savings account (powered by Paxos Trust Company) adds another layer of value with a competitive APY, though it’s important to note that savings products are not FDIC-insured like traditional bank accounts. For younger users or those who prefer peer-to-peer transactions, Venmo—owned by PayPal—also offers its own rewards system, including cashback on eligible debit card purchases.

Here’s how to optimize your rewards strategy in 2025:

- Stack rewards: Combine the PayPal Cashback Mastercard with retailer-specific promotions (often found in the mobile app) for double discounts.

- Monitor rotating categories: Some cards offer higher cashback rates in quarterly categories like gas or groceries.

- Use PayPal for crypto: Earn rewards when buying or selling cryptocurrency through PayPal’s platform, though fees and volatility should be considered.

- Leverage partnerships: PayPal frequently teams up with brands like Mastercard for exclusive offers, so keep an eye on your account notifications.

The program’s flexibility extends to payment processing for small businesses, where eligible transactions can also earn rewards. However, credit approval requirements vary, and users should always review terms to avoid surprises. With payment systems becoming more integrated, PayPal’s rewards ecosystem remains a top choice for hassle-free perks across financial services.

PayPal Credit Options

PayPal offers a range of credit options tailored to fit different financial needs, whether you're shopping online, managing cash flow, or earning rewards. One of the most popular choices is the PayPal Credit Card, issued by Synchrony Bank, which provides cash back on purchases and integrates seamlessly with your PayPal digital wallet. For those who prefer deferred payments, PayPal Credit (formerly Bill Me Later) allows you to buy now, pay later with promotional financing options, often featuring 0% APR for eligible purchases.

If you're looking for a debit alternative, the PayPal Debit Card (backed by Mastercard) lets you spend directly from your PayPal balance or linked bank account, with the added perk of 1% cash back on qualifying transactions. For savings-minded users, PayPal Savings (offered in partnership with Paxos Trust Company) provides a competitive APY, making it a smart place to park idle funds. Meanwhile, the PayPal Cashback Mastercard (issued by WebBank) rewards heavy spenders with 2% cash back on all purchases—no category restrictions.

Small businesses and freelancers can also benefit from PayPal Working Capital, a loan service that uses your sales history to determine credit approval, bypassing traditional credit checks. And let’s not forget Venmo, PayPal’s peer-to-peer payment app, which now offers its own Venmo Credit Card for users who want to earn rewards on everyday spending.

For those dipping into cryptocurrency, PayPal’s platform allows you to buy, sell, and hold crypto, with the option to pay for goods using your digital assets. The FDIC-insured features across some products (like PayPal Savings) add an extra layer of security, ensuring your money is protected.

Whether you’re after rewards, flexible payments, or high-yield savings, PayPal’s financial technology ecosystem has you covered. Just remember to compare terms—like APR, fees, and payment processing timelines—to pick the best option for your spending habits.

PayPal Customer Support

PayPal Customer Support is a critical aspect of the platform’s user experience, especially for those relying on its financial services like the PayPal Cashback Mastercard, PayPal Credit Card, or PayPal Debit Card. Whether you're dealing with payment processing issues, disputing a transaction, or troubleshooting your digital wallet, PayPal offers multiple support channels to resolve problems quickly. The company’s mobile app and website provide 24/7 access to live chat, phone support, and a comprehensive help center with step-by-step guides. For example, if you’re having trouble linking your Mastercard to your account, the help center walks you through the process with visual aids.

One standout feature is PayPal’s buy now pay later (BNPL) service, which allows users to split purchases into interest-free installments. If you encounter issues with BNPL approvals or repayment schedules, customer support can clarify eligibility requirements or assist with credit approval disputes. Similarly, users of PayPal Savings, backed by Synchrony Bank, can contact support for questions about APY rates or withdrawal delays. For cryptocurrency transactions involving Paxos Trust Company, PayPal’s team can guide you through buying, selling, or holding digital assets securely.

Businesses leveraging PayPal INC for online checkout or payment systems also benefit from dedicated merchant support. Whether it’s resolving delayed payouts or understanding fee structures, the priority is minimizing downtime. Smaller platforms like Venmo (owned by PayPal) share similar support infrastructure, though some users report faster resolution times for core PayPal services. Notably, while FDIC insurance covers balances in PayPal’s cash accounts, customer support can clarify coverage limits or direct you to WebBank for specific card-related inquiries.

Pro tip: If you’re locked out of your account, avoid generic emails—use the in-app chat for real-time assistance. PayPal’s AI-driven help bot can handle basic queries, but complex cases (like unauthorized transactions) are escalated to human agents. Always have your transaction ID or card details handy to speed up resolution. For frequent issues, the community forum crowdsources solutions from seasoned users, often providing workarounds before official patches roll out.

Ultimately, PayPal’s customer support shines in accessibility but can vary in responsiveness during peak times. Users recommend documenting all interactions, especially for disputes involving high-value transactions. Whether you’re a casual shopper or a business owner, understanding how to navigate these resources ensures smoother experiences with one of the world’s leading financial technology platforms.

PayPal Future Trends

PayPal Future Trends: Where Digital Payments Are Headed in 2025 and Beyond

As one of the pioneers in digital wallets and payment processing, PayPal is poised to redefine financial technology with several groundbreaking trends. The company’s partnership with Mastercard and integrations like the PayPal Cashback Mastercard highlight its push toward seamless, rewards-driven spending. Expect PayPal Credit Card and PayPal Debit Card offerings to evolve with smarter credit approval algorithms and personalized cash-back tiers, leveraging AI to analyze spending patterns.

A major focus for 2025 is cryptocurrency adoption. With Paxos Trust Company backing its stablecoin initiatives, PayPal could bridge the gap between traditional banking and crypto transactions. The PayPal Savings feature, powered by Synchrony Bank, might expand to include crypto staking or higher-yield APY options, competing directly with neo-banks. Meanwhile, Venmo (owned by PayPal) is likely to integrate deeper social payment features, like shared savings goals or group investing.

The buy now, pay later (BNPL) space will see PayPal doubling down, possibly introducing longer installment plans or bundling BNPL with PayPal Cashback Mastercard perks. Partnerships with WebBank could streamline approvals, making financing accessible at online checkouts. On the security front, FDIC-insured balances via partner banks will remain a selling point, especially as users demand safer ways to store funds in their digital wallet.

Lastly, watch for PayPal’s mobile app to become a one-stop hub—aggregating everything from payment systems to crypto trading, bill splitting, and even small-business tools. The shift toward embedded finance means PayPal won’t just process transactions; it’ll power entire financial ecosystems.

Key Takeaway: Whether it’s through crypto innovation, smarter credit products, or hyper-personalized rewards, PayPal’s 2025 strategy revolves around making money movement as intuitive as sending a text.