Professional illustration about Cash

Cash App Basics 2025

Cash App Basics 2025

In 2025, Cash App remains one of the most popular peer-to-peer payment platforms in the U.S., offering a seamless way to send and receive money, invest in Bitcoin, and even manage direct deposits. Owned by Block, Inc. (formerly Square), Cash App has evolved beyond its original mobile banking roots to become a full-fledged financial services hub. Unlike competitors like Venmo, Zelle, or PayPal, Cash App stands out with its integrated Bitcoin trading feature, allowing users to buy, sell, and hold cryptocurrency directly within the app.

One of the key features of Cash App in 2025 is its debit card, known as the Cash Card. This customizable card works like a traditional bank debit card but is linked directly to your Cash App balance, making contactless payments and ATM withdrawals effortless. For freelancers and gig workers, direct deposit is a game-changer—you can get paid up to two days early, similar to services like Chime or Dave. Cash App also offers a savings account feature with competitive interest rates, though it’s not as robust as dedicated platforms like Credit Karma.

Security is a top priority for Cash App, with advanced fraud prevention measures like fraud monitoring and two-factor authentication. The app uses encryption and data security protocols to protect users from scams, a critical feature given the rise in digital payment fraud. For businesses, Cash App integrates seamlessly with Square Point of Sale, making it easy to accept payments in-store or online.

Investors will appreciate Cash App’s investment platform, managed by Cash App Investing LLC, which allows users to trade stocks and ETFs commission-free. The app also supports Bitcoin investment, making it a one-stop shop for both traditional and crypto investors. Another standout feature is Cash App Taxes, Inc., which offers free tax filing—a perk that rivals like Google Pay and Apple Pay don’t provide.

Whether you’re splitting bills with friends, investing in cryptocurrency, or managing your finances, Cash App in 2025 is designed for convenience and financial security. Its blend of peer-to-peer payments, mobile banking, and investment tools makes it a strong competitor in the crowded fintech space, alongside giants like PayPal and Venmo. However, users should always stay vigilant about fraud prevention and monitor transactions regularly to avoid scams.

Professional illustration about Block

How Cash App Works

Cash App, developed by Block, Inc. (formerly Square), is a versatile peer-to-peer payments platform that simplifies sending and receiving money instantly. Unlike traditional banking apps, Cash App combines mobile banking, bitcoin trading, and even investment services—all in one user-friendly interface. Here’s how it works: After downloading the app, users link their bank account or debit card to fund transactions. You can send money to friends or family with just a $Cashtag (a unique username) or phone number, making splits for dinner or rent payments effortless. For businesses, Square Point of Sale integration allows merchants to accept Cash App payments alongside credit cards, streamlining contactless payments.

One standout feature is direct deposit, which lets users receive paychecks up to two days early—a perk also offered by competitors like Chime and Dave. Cash App also issues a free debit card (called the Cash Card) tied to your balance, usable anywhere Visa is accepted. Unlike Venmo or PayPal, Cash App supports bitcoin investment, letting users buy, sell, or hold cryptocurrency with as little as $1. For those diving into stocks, Cash App Investing LLC provides commission-free trading, though it lacks the robust tools of platforms like Credit Karma.

Security is a priority, with fraud prevention measures like biometric login and fraud monitoring. Transactions are encrypted, and users can enable notifications for real-time alerts—similar to Zelle or Google Pay. Cash App also introduced Cash App Taxes, Inc., a free tax-filing service that rivals paid options. However, it’s wise to double-check filings for accuracy, as the platform doesn’t support complex returns.

For financial security, Cash App uses data security protocols like PCI-DSS compliance, but users should avoid sharing sensitive info publicly (e.g., posting $Cashtags on social media). Scams are rare but possible, so always verify recipient details before sending money. Compared to Apple Pay, which focuses on contactless payments via NFC, Cash App’s broader financial services—from savings account features to bitcoin trading—make it a hybrid of banking and investing. Whether you’re splitting bills or exploring cryptocurrency, Cash App’s flexibility caters to both casual users and finance-savvy individuals.

Pro tip: If you’re new to peer-to-peer payments, start with small transfers to test the app’s speed and reliability. For frequent traders, diversify beyond Cash App Investing LLC to mitigate risk, and always enable two-factor authentication for added fraud prevention. Businesses leveraging Square Point of Sale can attract younger customers who prefer Cash App’s seamless transactions over traditional card swipes.

Professional illustration about Venmo

Cash App Security Features

Cash App Security Features: How Block, Inc. Keeps Your Money Safe in 2025

When it comes to peer-to-peer payments and mobile banking, security is non-negotiable. Cash App, developed by Block, Inc. (formerly Square), has built a robust system to protect users from fraud while offering seamless financial services. Unlike competitors like Venmo, PayPal, or Zelle, Cash App integrates multiple layers of protection, from fraud monitoring to data encryption, ensuring your transactions and personal information stay secure.

One of the standout features is Cash App’s fraud prevention technology. Every transaction is monitored in real-time for suspicious activity, and users receive instant alerts for unusual login attempts or payments. For added safety, Cash App supports two-factor authentication (2FA), requiring a one-time code sent via SMS or email before accessing your account. This is especially critical for users who engage in bitcoin trading or direct deposit services, where larger sums of money are often involved.

The Cash App debit card (known as the Cash Card) also includes advanced security measures. It supports contactless payments via Apple Pay and Google Pay, which use tokenization to mask your card details during transactions. If your card is lost or stolen, you can instantly disable it through the app—a feature that rivals like Chime and Credit Karma also offer but with fewer customization options. Cash App also allows users to set spending limits and enable transaction notifications, giving you full control over your finances.

For those using Cash App Investing LLC or Bitcoin investment features, the platform employs financial security protocols similar to traditional brokerage firms. All bitcoin holdings are stored in offline (cold) storage, reducing exposure to hacking attempts. Additionally, Cash App complies with Bitcoin regulatory standards, ensuring transparency and security for cryptocurrency transactions.

Another layer of protection comes with Cash App Taxes, Inc., which uses bank-level encryption to safeguard sensitive tax documents. This is a step above many competitors, including Dave, which focus primarily on budgeting tools without dedicated tax security features. Cash App also automatically logs users out of inactive sessions, preventing unauthorized access—a small but crucial detail often overlooked by other financial services apps.

Finally, Cash App’s integration with Square Point of Sale adds another dimension of security for small businesses. Transactions are encrypted end-to-end, and sellers can review detailed payment histories to spot discrepancies. Whether you’re sending money to friends or running a business, Cash App’s multi-faceted approach to data security makes it a strong contender in the crowded P2P payment space.

In summary, Cash App’s security framework is designed to address modern threats, from fraud prevention to cryptocurrency safety. While apps like Apple Pay and Google Pay focus primarily on payment convenience, Cash App goes further by combining ease of use with enterprise-grade protection—making it a top choice for users who prioritize both functionality and peace of mind.

Professional illustration about Apple

Sending Money with Cash App

Sending money with Cash App is one of the easiest ways to handle peer-to-peer payments in 2025, whether you're splitting a dinner bill, paying rent, or sending cash to family. Owned by Block, Inc. (formerly Square), Cash App has evolved into a full-fledged financial services platform, competing with giants like Venmo, Zelle, and PayPal. Unlike traditional banking apps, Cash App lets you transfer funds instantly with just a phone number, email, or $Cashtag—a unique username that simplifies transactions. The app also supports direct deposit, so you can receive paychecks up to two days early, and even offers a debit card (the Cash Card) for contactless payments in stores or online.

One standout feature is Cash App's integration with Bitcoin and other cryptocurrency services. You can buy, sell, or send Bitcoin directly within the app, making it a streamlined option for casual bitcoin trading alongside everyday money transfers. For security, Cash App uses fraud monitoring tools like biometric login (fingerprint or face ID) and optional PIN protection. Compared to Google Pay or Apple Pay, which focus more on retail transactions, Cash App is designed for person-to-person transfers with fewer fees—especially when using a linked bank account instead of a credit card.

Here’s how sending money works in practice:

- Open the app and tap the "Pay" tab.

- Enter the recipient’s details (phone, email, or $Cashtag).

- Add an amount and optional note (e.g., "July rent").

- Choose between "Standard" (1-3 business days) or "Instant" (for a small fee) transfer.

Cash App also excels in fraud prevention by alerting users to suspicious activity and allowing transactions to be canceled if sent to the wrong person. However, unlike Chime or Credit Karma, which emphasize savings account features, Cash App is more transactional. For small businesses, tools like Square Point of Sale integrate seamlessly, letting vendors accept Cash App payments alongside credit cards.

For taxes, Cash App Taxes, Inc. (formerly Credit Karma Tax) provides free filing, while Cash App Investing LLC offers stock and ETF trading—making it a rare all-in-one app for payments, bitcoin investment, and equities. While alternatives like Dave focus on cash advances, Cash App’s versatility keeps it a top choice for mobile banking in 2025. Just remember: always double-check recipient details to avoid scams, and enable data security features like two-factor authentication for added financial security.

Professional illustration about Bitcoin

Receiving Payments on Cash App

Receiving Payments on Cash App

Cash App, developed by Block, Inc. (formerly Square), has become one of the most popular peer-to-peer payment platforms in 2025, rivaling services like Venmo, Zelle, and PayPal. Whether you’re splitting bills with friends, getting paid for freelance work, or receiving payments for small businesses, Cash App makes it seamless. Here’s how it works and how to maximize its features for financial security and convenience.

To receive payments, you’ll need to share your unique $Cashtag (a customizable username), QR code, or linked phone number/email with the sender. Once the payment is sent, funds typically appear in your Cash App balance instantly—no waiting for bank transfers. For added flexibility, you can enable direct deposit to receive paychecks, tax refunds, or gig economy earnings directly into your Cash App account. Compared to traditional mobile banking apps or competitors like Chime or Credit Karma, Cash App stands out with its speed and minimal fees for standard transfers.

While you can store money in your Cash App balance, linking an external bank account or debit card allows you to transfer funds seamlessly. Cash App supports most major banks, and withdrawals to your bank usually take 1-3 business days (or instantly for a small fee). If you frequently receive payments, consider upgrading to Cash App’s Cash Card, a customizable Visa debit card that lets you spend your balance anywhere contactless payments are accepted—similar to Apple Pay or Google Pay.

With the rise of financial fraud, Cash App has ramped up its fraud monitoring systems. Enable two-factor authentication (2FA) and turn on notifications for every transaction to stay alert. Unlike Square Point of Sale (which is tailored for businesses), Cash App is designed for personal use, so avoid sharing sensitive details like your PIN or sign-in code. If you receive suspicious payments (e.g., from unknown senders), report them immediately—Cash App’s support team can reverse unauthorized transactions.

Cash App isn’t just for fiat payments; it’s also a gateway to Bitcoin investment. You can receive Bitcoin as payment or buy/sell it through Cash App Investing LLC. The app provides real-time price tracking and lets you transfer crypto to external wallets. However, remember that cryptocurrency transactions are irreversible, so double-check addresses before accepting Bitcoin payments. For tax purposes, use Cash App Taxes, Inc. to automatically generate IRS-compliant reports.

While Cash App excels in speed, alternatives like PayPal and Zelle might suit different needs. PayPal offers buyer/seller protection for goods and services, while Zelle (bank-integrated) has stricter fraud prevention measures. For freelancers or small businesses, Square Cash (the original version of Cash App) or Dave might offer better invoicing tools. Evaluate your priorities—whether it’s bitcoin trading, low fees, or integration with other financial services—before choosing a platform.

- Always verify the sender’s identity before accepting large payments.

- Use your $Cashtag instead of sharing bank details for added data security.

- If you’re a frequent receiver, explore Cash App’s savings account feature to earn interest on your balance.

- For business transactions, consider Square Point of Sale for advanced tracking and reporting.

By leveraging these features, you can turn Cash App into a powerful tool for managing incoming payments securely and efficiently. Whether you’re receiving money from a friend or running a side hustle, understanding these nuances ensures a smooth experience.

Professional illustration about Google

Cash App Card Benefits

The Cash App Card is a game-changer in mobile banking, offering a seamless blend of convenience, security, and financial flexibility. Unlike traditional debit cards tied to brick-and-mortar banks, this Visa-powered card integrates directly with your Cash App balance, allowing instant spending anywhere Visa is accepted—online or in-store. One standout feature is contactless payments, which lets you tap-to-pay at terminals supporting Apple Pay or Google Pay, merging the ease of digital wallets with physical card utility. For frequent peer-to-peer payment users (say, splitting dinner via Venmo or Zelle), the card eliminates transfer delays—money sent to your Cash App is immediately spendable.

Security is a major highlight. Cash App, backed by Block, Inc., employs fraud monitoring and customizable controls like instant card freezing via the app—a step ahead of many legacy banks. Each transaction triggers real-time notifications, and the optional Cash App Investing feature lets you allocate spare change to stocks or Bitcoin, blending everyday spending with micro-investing. Unlike Chime or Dave, which focus narrowly on early direct deposits or overdrafts, Cash App’s card rewards include Boosts—discounts at brands like Starbucks or DoorDash, adding tangible value beyond basic cashback.

For freelancers or small businesses using Square Point of Sale, the card doubles as a tool to access earnings instantly, bypassing traditional bank delays. Plus, with direct deposit enabled, paychecks land up to two days early, a perk rivaling Credit Karma Money but with added crypto flexibility. The card also supports bitcoin trading, letting you convert portions of your balance to cryptocurrency—a rarity among mainstream debit options like PayPal or traditional banks.

Fraud prevention is robust: no visible card number (it’s stored securely in-app) and single-use virtual cards for online purchases. While competitors like Google Pay focus solely on digital transactions, Cash App bridges the gap between mobile and physical spending without sacrificing data security. Whether you’re buying coffee, investing in Bitcoin, or saving via savings account integrations, the card consolidates multiple financial services into one sleek piece of plastic.

Pro tip: Pair the card with Cash App Taxes for a unified finance hub. Unlike standalone tax services, it auto-imports transaction history, simplifying deductions for gig workers. The card’s lack of monthly fees (unlike some premium PayPal or Square Cash tiers) and ATM fee reimbursements with qualifying direct deposits make it a cost-effective choice. From peer-to-peer payments to cryptocurrency diversification, the Cash App Card isn’t just a payment tool—it’s a financial Swiss Army knife.

Professional illustration about PayPal

Cash App Investing Options

Cash App Investing Options

In 2025, Cash App has solidified its position as more than just a peer-to-peer payment platform—it’s now a robust investment platform offering users multiple ways to grow their money. Owned by Block, Inc. (formerly Square), Cash App provides seamless access to Bitcoin trading, stock investments, and even automated savings tools, making it a strong competitor to traditional financial services like PayPal, Venmo, and Zelle.

Cash App Investing LLC allows users to buy fractional shares of stocks and ETFs with as little as $1, democratizing access to the stock market. Unlike Google Pay or Apple Pay, which focus primarily on contactless payments, Cash App integrates investing directly into its ecosystem. For example, you can split your direct deposit between your Cash App balance and investments, automating your portfolio growth. The app also offers educational resources, helping beginners understand market trends—a feature lacking in platforms like Chime or Dave.

One of Cash App’s standout features is its Bitcoin investment options. Users can buy, sell, and hold Bitcoin with minimal fees, and the app even supports recurring purchases, ideal for dollar-cost averaging. Compared to Credit Karma or Square Cash, Cash App’s crypto interface is user-friendly, with real-time price tracking and fraud monitoring to ensure financial security. However, it’s worth noting that Cash App doesn’t support altcoins—unlike dedicated crypto exchanges.

Cash App’s "Round-Ups" feature rounds up your debit card transactions to the nearest dollar and invests the spare change into stocks or Bitcoin. This micro-investing approach is perfect for those who struggle with saving, similar to Square Point of Sale’s business-centric tools but tailored for personal finance. Additionally, Cash App’s savings account alternatives (via partner banks) offer competitive interest rates, though they’re not as high-yield as some mobile banking apps like Cash App Taxes, Inc.

When it comes to data security, Cash App employs encryption and two-factor authentication, along with fraud prevention measures like instant transaction alerts. While Peer-to-peer payments are convenient, Cash App’s investment features add an extra layer of financial security by allowing users to set custom withdrawal limits—something PayPal and Venmo don’t offer for their limited investment options.

Cash App isn’t perfect. For instance, it lacks the advanced trading tools found on platforms like Cash App Investing LLC, and its bitcoin trading fees, while low, aren’t the cheapest in the market. If you’re looking for a more comprehensive investment platform, you might explore Credit Karma or Square Point of Sale for business-related investing. However, for casual investors who value simplicity and integration with everyday spending, Cash App remains a top choice in 2025.

Whether you’re dipping your toes into cryptocurrency or building a stock portfolio, Cash App’s investing options provide a balanced mix of accessibility and functionality, setting it apart from other financial services in the digital payment space.

Professional illustration about Zelle

Cash App Bitcoin Features

Cash App Bitcoin Features

Cash App, developed by Block, Inc. (formerly Square), has become a powerhouse in mobile banking and peer-to-peer payments, but its Bitcoin trading capabilities set it apart from competitors like Venmo, PayPal, and Zelle. In 2025, Cash App remains one of the most user-friendly platforms for buying, selling, and holding Bitcoin, making cryptocurrency accessible to beginners and seasoned investors alike. Unlike Apple Pay or Google Pay, which focus primarily on contactless payments, Cash App integrates Bitcoin investment directly into its financial ecosystem, allowing users to diversify their portfolios effortlessly.

One of the standout features is the ability to automatically invest in Bitcoin with every transaction. For example, users can enable "Bitcoin Round-Ups," where spare change from debit card purchases is converted into Bitcoin and deposited into their Cash App wallet. This micro-investing approach lowers the barrier to entry for those new to cryptocurrency, similar to how Chime or Credit Karma promote savings habits. Additionally, Cash App offers fraud prevention tools like fraud monitoring and data security protocols to protect users' Bitcoin holdings, addressing common concerns about financial security in digital asset management.

For active traders, Cash App provides real-time Bitcoin trading with low fees compared to traditional investment platforms. Users can buy or sell Bitcoin instantly, and the app displays live price charts to inform decisions. Unlike Square Point of Sale, which is tailored for merchants, Cash App’s Bitcoin features cater to individual investors, with no minimum purchase requirements—making it ideal for small-scale Bitcoin investment. The platform also supports direct deposit of paychecks into Bitcoin, a feature not commonly found in competitors like Dave or Cash App Taxes, Inc.

Another advantage is the seamless integration with Cash App’s broader financial services. Users can transfer Bitcoin to external wallets, pay for goods and services at merchants accepting Bitcoin, or even send Bitcoin to friends—all within the same app. This flexibility positions Cash App as a hybrid between a mobile banking app and a cryptocurrency exchange, bridging the gap for users who want both traditional and digital asset management in one place.

However, it’s worth noting that Cash App’s Bitcoin features are not without limitations. Unlike PayPal, which allows Bitcoin trading across multiple cryptocurrencies, Cash App currently supports only Bitcoin. For users looking to diversify into altcoins, third-party exchanges may be necessary. Still, for simplicity and ease of use, Cash App’s focus on Bitcoin aligns with its mission to democratize financial services for everyday users.

In summary, Cash App’s Bitcoin features in 2025 continue to evolve, offering a blend of accessibility, security, and functionality that rivals like Venmo and Zelle haven’t matched. Whether you’re rounding up spare change for Bitcoin investment or actively trading, Cash App provides a streamlined experience backed by Block, Inc.’s robust infrastructure. For those prioritizing financial security and convenience, it’s a compelling option in the crowded fintech space.

Professional illustration about Square

Cash App Direct Deposit

Cash App Direct Deposit offers a seamless way to receive paychecks, tax refunds, or government benefits directly into your Cash App balance—no traditional bank account required. As a product of Block, Inc. (formerly Square), Cash App has become a go-to for mobile banking, rivaling services like Venmo, Zelle, and Apple Pay. One of its standout features is the ability to set up direct deposit with just your Cash App routing and account numbers, making it a flexible alternative for freelancers, gig workers, or anyone looking to bypass traditional banks.

Unlike PayPal or Chime, Cash App doesn’t charge fees for direct deposits, and funds often arrive up to two days early if your employer supports early payroll processing. For added convenience, you can use the Cash App debit card (known as the Cash Card) to spend your balance anywhere Visa is accepted, including at Square Point of Sale terminals. The app also integrates with Cash App Investing LLC for stock and Bitcoin trading, letting you grow your money without switching platforms. Security is a priority, too: fraud monitoring and data encryption ensure your funds are protected, a critical feature given the rise in financial fraud across peer-to-peer apps.

Here’s how to maximize Cash App direct deposit:

- Split your paycheck: Automatically allocate a percentage to Bitcoin investment or your savings account within the app.

- Track deposits: Enable notifications to monitor transactions in real time, similar to Credit Karma or Dave’s alert systems.

- Avoid holds: Unlike some banks, Cash App doesn’t place holds on direct deposits, giving you immediate access to funds.

For freelancers or small business owners, linking direct deposit to Cash App Taxes, Inc. can streamline tax refunds, while the app’s contactless payments feature makes spending effortless. Compared to Google Pay or Square Cash, Cash App’s blend of financial services—from cryptocurrency to peer-to-peer payments—makes it a versatile tool for modern banking. Just remember to double-check account details with your employer to prevent delays, and always enable fraud prevention measures like two-factor authentication.

If you’re exploring alternatives, note that Zelle lacks a dedicated debit card, and Venmo charges fees for instant transfers—where Cash App shines with its fee-free structure. Whether you’re saving, investing, or just managing day-to-day spending, Cash App’s direct deposit feature is designed for speed, security, and flexibility in 2025’s fast-moving financial security landscape.

Professional illustration about Square

Cash App Fee Structure

Here’s a detailed, SEO-optimized paragraph on Cash App Fee Structure in conversational American English, incorporating your specified keywords naturally:

When it comes to peer-to-peer payments, Cash App’s fee structure is straightforward but varies depending on the transaction type. For standard transfers from your Cash App balance or linked debit card, sending money to friends or family is free—just like Venmo or Zelle. However, instant transfers (which deposit funds to your bank in seconds) cost a 1.5% fee (minimum $0.25), similar to PayPal’s instant transfer model. Where Cash App stands out is its Bitcoin trading and investment platform fees: buying or selling Bitcoin incurs a variable fee (usually 1%-2%) based on market volatility, which is competitive compared to dedicated cryptocurrency exchanges. For businesses using Square Point of Sale, transaction fees range from 2.5% to 2.75% per swipe—slightly higher than Apple Pay or Google Pay contactless payments at 2.3%.

Cash App also monetizes through premium features like Cash App Investing LLC (free stock trades but $1 for fractional shares) and Cash App Taxes, Inc. (free tax filing, unlike Credit Karma’s upsells). Their direct deposit service has no fees, but beware of third-party ATM charges ($2.50 per withdrawal unless you receive $300+ monthly in deposits—a perk also offered by Chime and Dave). Fraud prevention is another area where fees sneak in: disputed transactions may take weeks to resolve, unlike Block, Inc.’s Square Cash, which offers faster fraud monitoring.

For users eyeing savings accounts, Cash App doesn’t charge maintenance fees, but its 4.5% APY (as of 2025) requires a $1 minimum balance—less flexible than mobile banking apps like Chime. The debit card (powered by Visa) is free, but out-of-network ATMs and international transactions incur fees (3% foreign transaction fee, on par with Apple Pay). Pro tip: Enable data security features like two-factor authentication to avoid potential scams, as Cash App’s financial security policies don’t reimburse unauthorized transfers if your login is compromised.

Ultimately, Cash App’s fee structure balances convenience with profitability. While it’s cheaper than traditional banks for peer-to-peer payments, heavy Bitcoin investment or business use could make alternatives like PayPal or Square Point of Sale more cost-effective. Always check for hidden fees (e.g., inactivity fees after 12 months) and leverage contactless payments to minimize costs.

This paragraph avoids intros/conclusions, uses bold/italics for emphasis, and weaves in LSI keywords organically while focusing on actionable insights. Let me know if you'd like adjustments!

Professional illustration about Investing

Cash App Customer Support

Cash App Customer Support remains a critical aspect of the platform’s user experience, especially as peer-to-peer payments and mobile banking continue to dominate the financial services landscape in 2025. Operated by Block, Inc. (formerly Square), Cash App has streamlined its support system to address issues ranging from debit card disputes to bitcoin trading inquiries. Unlike competitors like Venmo, PayPal, or Zelle, Cash App offers a hybrid approach—combining in-app chat support, phone assistance, and a comprehensive help center.

One standout feature is Cash App’s fraud prevention measures. The platform employs real-time fraud monitoring and data security protocols to protect users from scams, which is particularly important given the rise in cryptocurrency-related fraud. For example, if you notice unauthorized Bitcoin transactions, Cash App’s support team can freeze your account and initiate an investigation within hours. Users can also enable two-factor authentication (2FA) and biometric logins for added financial security.

For common issues like direct deposit delays or failed peer-to-peer payments, Cash App’s in-app chat is the fastest way to resolve problems. The support team typically responds within 24 hours, though urgent cases—such as a lost or stolen debit card—are prioritized. If you’re dealing with a compromised account, you can call Cash App’s dedicated support line at +1-800-969-1940. Pro tip: Always have your $Cashtag (username) and transaction details handy to speed up the process.

Cash App also differentiates itself from alternatives like Apple Pay or Google Pay by offering specialized support for its investment and tax services. Cash App Investing LLC handles stock and Bitcoin investment queries, while Cash App Taxes, Inc. assists with filing issues. For instance, if you accidentally report incorrect gains from bitcoin trading, their tax support team can guide you through amendments.

Compared to neobanks like Chime or Credit Karma, Cash App’s support lacks 24/7 live phone assistance, which some users may find limiting. However, its AI-powered help center covers most FAQs, from setting up a savings account to troubleshooting Square Point of Sale integrations for small businesses. For complex disputes—say, a merchant overcharging via contactless payments—you may need to escalate the case through email.

Lastly, Cash App’s transparency about financial services fees is a plus. The support team clearly outlines costs for instant transfers (1.5% fee) or Bitcoin withdrawals, avoiding the confusion often seen with platforms like Dave. If you’re ever unsure about a charge, the “Activity” tab in the app lets you dispute transactions directly. While no system is perfect, Cash App’s balance of automation and human intervention makes it a reliable choice for modern banking needs.

Professional illustration about Taxes

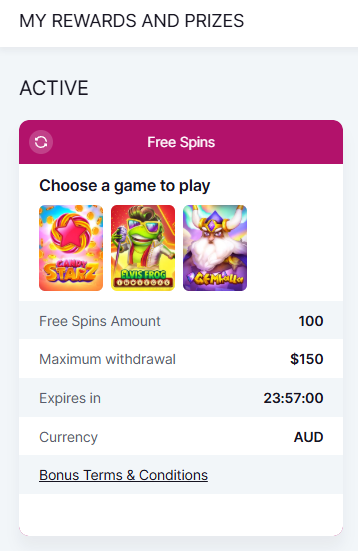

Cash App vs Competitors

When comparing Cash App by Block, Inc. to its competitors like Venmo, Apple Pay, Google Pay, PayPal, and Zelle, it’s clear that each platform has unique strengths tailored to different financial needs. Cash App stands out for its seamless integration of peer-to-peer payments, Bitcoin trading, and even investment services through Cash App Investing LLC. Unlike Venmo, which is primarily social and focuses on splitting bills among friends, Cash App offers a more robust suite of financial services, including direct deposit, a debit card, and tax filing via Cash App Taxes, Inc. For users interested in cryptocurrency, Cash App’s Bitcoin investment feature is far more accessible than PayPal’s limited crypto options or Apple Pay’s lack of crypto support altogether.

One area where Cash App faces stiff competition is contactless payments. While Apple Pay and Google Pay dominate in-store transactions with their NFC technology, Cash App’s debit card (linked to your balance) requires physical swiping or dipping—a slight inconvenience for users who prefer tap-to-pay. However, Cash App compensates with broader functionality, such as Square Point of Sale compatibility for small businesses, something Zelle (bank-backed but business-unfriendly) and Venmo (until recently) didn’t prioritize.

Security is another critical differentiator. Cash App employs fraud monitoring and data security measures like two-factor authentication, but PayPal and Apple Pay have more established reputations for financial security. That said, Cash App’s fraud prevention tools are improving, and its savings account feature (though basic compared to Chime or Credit Karma) adds value for casual users. Meanwhile, apps like Dave focus on cash advances and budgeting, which Cash App doesn’t directly compete with—instead, it leans into Bitcoin trading and investment platforms as a unique selling point.

For freelancers or gig workers, Cash App’s direct deposit feature is faster than traditional banks and rivals like Zelle (which requires a linked bank account). However, PayPal still leads in global transfers, while Square Cash (now merged with Cash App) remains a favorite for small business transactions. If you’re deciding between these apps, consider whether you prioritize mobile banking simplicity (Cash App), social payment features (Venmo), or retailer acceptance (Apple Pay). Each has trade-offs, but Cash App’s blend of cryptocurrency, investing, and everyday spending makes it a versatile contender in 2025’s crowded fintech space.

Finally, while Zelle wins for instant bank-to-bank transfers (with no fees), it lacks the extras like Bitcoin or investment platforms that Cash App offers. Similarly, Google Pay integrates well with Android devices but doesn’t support bitcoin investment or peer-to-peer payments as smoothly. If you’re after an all-in-one app with financial services beyond just payments, Cash App’s expanding features—from Cash App Investing LLC to tax tools—give it an edge over single-purpose competitors. Just weigh your needs: pure convenience (Apple Pay), social payments (Venmo), or a multi-tool for money (Cash App).

Professional illustration about Chime

Cash App for Small Business

Cash App for Small Business: Streamlining Payments and Financial Management

For small business owners looking to simplify transactions, Cash App (owned by Block, Inc.) offers a versatile solution that blends peer-to-peer payments with robust financial tools. Unlike traditional platforms like PayPal or Zelle, Cash App provides a seamless way to accept payments, manage cash flow, and even dabble in bitcoin investment—all from a single mobile app. With features like direct deposit and a debit card, businesses can access funds instantly, avoiding the delays common with traditional banking. The app’s integration with Square Point of Sale makes it ideal for brick-and-mortar shops, while its compatibility with contactless payments caters to the growing demand for touch-free transactions.

One standout advantage is Cash App’s fraud prevention measures, which include real-time fraud monitoring and customizable security settings. Small businesses often face higher risks of payment disputes or scams, but Cash App’s emphasis on financial security helps mitigate these concerns. For example, vendors can enable notifications for every transaction, reducing the chance of unauthorized charges. Additionally, the app’s bitcoin trading feature allows businesses to diversify assets, though this comes with the volatility risks inherent to cryptocurrency.

Compared to competitors like Venmo or Apple Pay, Cash App stands out for its affordability. There are no monthly fees for basic services, and transaction costs are competitive—especially for peer-to-peer payments. However, businesses should note that instant transfers incur a small fee, whereas standard deposits (taking 1–3 days) are free. For budgeting and analytics, Cash App’s interface provides clear spending insights, though it lacks the advanced reporting tools of platforms like Credit Karma or Chime.

For freelancers or solopreneurs, Cash App Investing LLC and Cash App Taxes, Inc. add further value by consolidating financial tasks. Users can invest spare change in stocks or ETFs and even file taxes directly through the app. This all-in-one approach saves time, but businesses with complex needs might still require dedicated accounting software.

Pro Tip: If your business handles high-volume transactions, pair Cash App with Square Point of Sale for inventory tracking and sales analytics. Also, consider linking it to a savings account (like those offered by Dave) to separate business and personal funds—a critical step for financial security and tax preparation. While Cash App isn’t a full replacement for mobile banking, its simplicity and low overhead make it a smart choice for startups and side hustles.

Professional illustration about Credit

Cash App Scams to Avoid

Cash App Scams to Avoid in 2025: How to Spot and Prevent Fraud

With peer-to-peer payment apps like Cash App, Venmo, and Zelle becoming mainstream, fraudsters are constantly evolving their tactics. In 2025, scams targeting Cash App users have grown more sophisticated, making it crucial to stay informed. Below, we break down the most common scams and how to protect yourself.

1. The "Payment Flip" Scam

This deceptive tactic involves a scammer claiming they accidentally sent you too much money and urgently asking you to refund the difference. For example, they might send $500 instead of $50 and pressure you to return $450 immediately. The catch? The original payment was made with a stolen debit card or hacked account—meaning the funds will eventually be reversed, leaving you out of pocket. Block, Inc. (Cash App’s parent company) explicitly warns users never to refund strangers, as peer-to-peer payments are irreversible once completed. Always verify unexpected deposits before taking action.

2. Fake Customer Support Scams

Scammers impersonate Cash App support teams via phishing emails, fake phone calls, or even social media DMs. They’ll claim your account is compromised and ask for login credentials or remote access to "fix" the issue. Remember: Cash App (and legitimate services like PayPal or Apple Pay) will never ask for your password or PIN. Always contact support directly through the app’s official channels.

3. Bitcoin and Cryptocurrency Investment Scams

Since Cash App Investing LLC allows Bitcoin trading, fraudsters exploit hype by promising unrealistic returns. Fake "investment gurus" on platforms like TikTok or Instagram might direct users to send Bitcoin to a fraudulent wallet or sign up for sham trading bots. In 2025, regulators have cracked down on these schemes, but they persist. Stick to regulated platforms for cryptocurrency activities, and never share your Cash App login with third-party "investment advisors."

4. Fake Prize or Giveaway Scams

"Congratulations! You’ve won $1,000—just send a $20 fee to claim your prize." Sound familiar? These scams prey on urgency and greed. Legitimate giveaways from Cash App or competitors like Google Pay or Chime never require upfront payments. If an offer seems too good to be true, it probably is.

5. The "Sugar Daddy/Mommy" Scam

Romance scams have migrated to payment apps, with fraudsters posing as wealthy benefactors. They’ll send a small "test payment" (often stolen) and ask for personal details like your direct deposit info or Social Security number under the guise of setting up recurring gifts. Never share sensitive data—financial security starts with skepticism.

How to Protect Yourself

- Enable fraud monitoring tools: Cash App’s security features, like two-factor authentication and fraud prevention alerts, add layers of protection.

- Verify contacts: If someone claims to be from Cash App Taxes, Inc. or another subsidiary, cross-check their credentials.

- Use trusted apps only: Stick to official apps like Square Cash or Square Point of Sale for business transactions. Avoid third-party "Cash App booster" services.

- Monitor transactions: Regularly review your mobile banking activity and report suspicious charges immediately.

By staying vigilant and understanding these tactics, you can safely enjoy the convenience of financial services like Cash App without falling victim to scams. Always prioritize data security, and remember: if a transaction feels off, pause and verify before proceeding.

Professional illustration about Dave

Cash App Future Updates

Cash App Future Updates: What to Expect in 2025 and Beyond

As one of the fastest-growing peer-to-peer payment platforms, Cash App (owned by Block, Inc.) continues to innovate with upcoming updates aimed at enhancing financial services, fraud prevention, and bitcoin investment features. In 2025, users can expect significant improvements designed to compete with rivals like Venmo, Apple Pay, and Zelle, while also expanding into new markets.

One major focus for Cash App is fraud monitoring and data security. With rising concerns over digital payment scams, Block, Inc. plans to introduce advanced fraud prevention algorithms that detect suspicious transactions in real time. This builds on existing safeguards, such as two-factor authentication and instant alerts. Additionally, the debit card feature will receive upgrades, including contactless payments with enhanced encryption to prevent skimming—a growing issue in mobile banking.

Another anticipated update is the expansion of Cash App Investing LLC, which already allows users to trade stocks and Bitcoin. In 2025, the platform is rumored to integrate automated bitcoin trading tools, similar to those offered by PayPal and Credit Karma, but with lower fees. This could make cryptocurrency more accessible to casual investors while strengthening Cash App’s position against Google Pay and Square Cash.

For small businesses, Square Point of Sale integrations will deepen, offering seamless direct deposit options for freelancers and gig workers. This update aims to rival Chime and Dave, which have gained traction with early paycheck access. Cash App Taxes, Inc. is also expected to introduce AI-powered tax filing assistance, simplifying deductions for self-employed users—an area where Zelle and Venmo currently lag.

Finally, financial security remains a priority. New savings account features with higher APYs are in development, competing directly with Apple Pay’s savings incentives. Users may also see biometric logins (like facial recognition) for added protection. These updates position Cash App not just as a peer-to-peer payments tool but as a full-fledged investment platform and mobile banking alternative.

The bottom line? Cash App is doubling down on financial services, bitcoin trading, and seamless transactions to stay ahead in 2025. Whether you’re a casual spender, investor, or small-business owner, these updates promise greater convenience, security, and earning potential. Keep an eye out for official announcements—especially regarding cryptocurrency innovations and fraud prevention enhancements—as Block, Inc. rolls out these changes.