Professional illustration about Binance

Binance in 2025 Overview

Binance in 2025 Overview

As one of the world’s largest crypto exchanges, Binance continues to dominate the crypto trading landscape in 2025, despite facing evolving financial regulations and competitive pressures. Under the leadership of Richard Teng, who took over after Changpeng Zhao stepped down, the platform has prioritized regulatory compliance while expanding its global footprint. With key operations in Binance.US, Binance Bermuda, and Binance Japan, the exchange has adapted to regional laws, ensuring smoother access to digital assets for users worldwide.

The crypto market in 2025 sees Binance maintaining its stronghold with innovations like its BNB token, which remains a top choice for traders due to its utility across the blockchain ecosystem. The exchange’s trading volume for major cryptocurrencies like Bitcoin and Ethereum still leads competitors such as Coinbase and the revived FTX, thanks to low fees and a robust Crypto Wallet infrastructure. However, challenges persist, particularly around money laundering concerns and stricter financial regulation in markets like Binance China and Binance Malta, where compliance frameworks have tightened.

For those looking to invest in crypto, Binance offers a streamlined Buy Crypto interface, supporting fiat-to-crypto purchases and a wide range of stablecoin pairs. The platform’s Crypto Trading tools, including advanced charting and margin options, cater to both beginners and seasoned traders. Meanwhile, Yi He, co-founder of Binance, has emphasized user education, with resources on cryptocurrency security and market trends.

Despite regulatory hurdles, Binance Shanghai remains a hub for blockchain innovation, focusing on decentralized finance (DeFi) projects. The exchange’s ability to navigate regulatory compliance while fostering crypto exchange growth highlights its resilience. In 2025, Binance’s strategy balances expansion with risk management, ensuring it stays ahead in the fast-evolving digital assets space.

Key takeaways for users:

- BNB continues to power the Binance ecosystem, offering discounts and staking rewards.

- Regional adaptations (e.g., Binance.US vs. Binance Japan) reflect tailored compliance approaches.

- Crypto Wallet integrations and stablecoin support enhance liquidity and trading flexibility.

- Regulatory scrutiny remains a critical factor, especially in markets with strict financial regulation.

For traders, staying updated on Binance’s evolving policies and leveraging its Crypto Market tools can maximize opportunities in 2025’s volatile landscape.

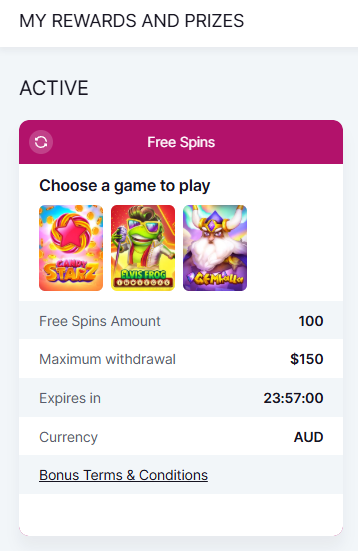

Professional illustration about BNB

Binance Trading Fees Explained

Binance Trading Fees Explained

Understanding Binance’s trading fees is crucial for anyone actively involved in crypto trading, whether you're a beginner or a seasoned trader. As one of the largest crypto exchanges globally, Binance offers a competitive fee structure, but it varies depending on factors like trading volume, membership tiers, and whether you use BNB (Binance’s native token) to pay fees. Here’s a breakdown of how it works in 2025.

Binance operates on a maker-taker model, where fees differ based on whether you add liquidity (maker) or take liquidity (taker) from the market. For standard users, the starting fee is 0.1% for both makers and takers, which is lower than many competitors like Coinbase or FTX before its collapse. However, fees can drop significantly if you qualify for VIP tiers by increasing your 30-day trading volume or holding a certain amount of BNB in your crypto wallet.

For example:

- VIP 0 (Basic): 0.1% maker / 0.1% taker

- VIP 1 (30-day volume ≥ 50 BTC): 0.09% maker / 0.1% taker

- VIP 9 (30-day volume ≥ 150,000 BTC): 0.02% maker / 0.04% taker

One of the easiest ways to reduce fees is by enabling the "Pay with BNB" option, which grants a 25% discount on trading fees. This makes BNB a valuable asset beyond just price speculation. Additionally, trading stablecoin pairs (like USDT/BUSD) often incurs lower fees compared to volatile pairs like Bitcoin or Ethereum, as they’re less risky for the exchange.

It’s important to note that Binance.US, the platform serving U.S. customers, has a slightly different fee structure due to financial regulation compliance. While the global Binance platform offers lower fees, Binance.US charges a flat 0.1% fee for both makers and takers, with no BNB discounts as of 2025. Regulatory pressures in regions like Binance Bermuda, Binance Japan, and Binance Malta have also led to localized adjustments, so always check the latest updates based on your jurisdiction.

Binance frequently runs zero-fee trading promotions for specific crypto markets, such as Bitcoin or Ethereum spot trading pairs, to attract liquidity. High-volume traders can also negotiate custom fee schedules directly with Binance, a perk often utilized by institutional investors. Under CEO Richard Teng (who succeeded Changpeng Zhao in 2023), Binance has maintained transparency about fee changes, aligning with stricter regulatory compliance standards to avoid past controversies like money laundering allegations.

When stacked against rivals like Coinbase, Binance’s fees are generally more competitive, especially for active traders. Coinbase’s standard fee starts at 0.6% for smaller trades, while Binance’s tiered system rewards high-frequency trading. However, newcomers should weigh fees against other factors like security, crypto wallet integration, and ease of buy crypto options.

- Use BNB: Always opt to pay fees with BNB for instant savings.

- Aim for VIP Tiers: Increase your trading volume strategically to unlock lower rates.

- Trade Stablecoins: Stick to stablecoin pairs when possible for reduced costs.

- Watch for Promos: Binance often announces limited-time fee waivers—stay updated.

By mastering Binance’s fee dynamics, traders can optimize their invest in crypto strategy and keep more profits in their pockets. Whether you’re trading on Binance Shanghai or Binance China (where regulations differ), always cross-check the latest fee schedules to avoid surprises.

Professional illustration about Binance

Binance Security Features 2025

Binance Security Features 2025: How the Leading Crypto Exchange Keeps Your Assets Safe

In 2025, Binance continues to set the gold standard for security in the crypto exchange space, leveraging cutting-edge technology and strict regulatory compliance to protect users' digital assets. Under the leadership of Richard Teng, who succeeded Changpeng Zhao, the platform has doubled down on its commitment to safeguarding crypto trading activities across its global entities, including Binance.US, Binance Japan, and Binance Bermuda. One of the standout features is its multi-tier and multi-cluster system architecture, which ensures that even if one server fails, the entire system remains operational. This redundancy is critical for maintaining uninterrupted trading volume, especially during market volatility.

For crypto wallet security, Binance employs cold storage for the majority of user funds, keeping them offline and out of reach from hackers. Additionally, the exchange uses HSM (Hardware Security Modules) to encrypt private keys, adding an extra layer of protection. Users can also enable two-factor authentication (2FA) via SMS or authenticator apps, a must-have for anyone serious about securing their Bitcoin, Ethereum, or BNB holdings. In 2025, Binance introduced biometric verification for high-value withdrawals, requiring fingerprint or facial recognition—a feature praised for reducing money laundering risks.

Another major upgrade is Binance’s AI-driven fraud detection system, which monitors transactions in real-time to flag suspicious activity. This system cross-references data with global financial regulation standards, ensuring compliance while preventing unauthorized access. Compared to competitors like Coinbase and the defunct FTX, Binance’s proactive approach to security has helped it maintain trust among traders. The platform also conducts regular third-party audits, with results published transparently to reassure users.

For those looking to invest in crypto safely, Binance offers SAFU (Secure Asset Fund for Users), an emergency insurance fund that covers losses in extreme scenarios. This fund, worth billions, is a testament to Binance’s dedication to user protection. Meanwhile, Yi He, co-founder of Binance, has emphasized the importance of stablecoin security, ensuring that assets like USDT and USDC are backed 1:1 with reserves—a critical factor in maintaining crypto market stability.

Finally, Binance’s regulatory compliance team works closely with authorities in Binance Shanghai, Binance Malta, and other jurisdictions to stay ahead of evolving laws. The exchange’s Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are among the strictest in the industry, requiring detailed verification for high-tier accounts. Whether you're a beginner looking to buy crypto or a seasoned trader, Binance’s 2025 security features provide peace of mind in an increasingly complex blockchain ecosystem.

Professional illustration about Binance

Binance Mobile App Review

The Binance mobile app remains one of the most powerful tools for crypto trading in 2025, offering a seamless experience for both beginners and advanced traders. Available globally (with regional variations like Binance.US, Binance Japan, and Binance Bermuda), the app supports a wide range of digital assets, including Bitcoin, Ethereum, and BNB, Binance’s native token. The interface is intuitive, with customizable dashboards that let users track crypto market trends, set price alerts, and execute trades in seconds. One standout feature is the Buy Crypto option, which simplifies onboarding with fiat-to-crypto purchases via credit cards, bank transfers, or even P2P trading. For security-conscious users, the app integrates robust measures like two-factor authentication (2FA) and biometric login, aligning with financial regulation standards to prevent money laundering.

Under the leadership of Richard Teng, who took over after Changpeng Zhao stepped down, Binance has doubled down on regulatory compliance, reflected in the app’s transparency features. For example, trading pairs are clearly labeled with risk warnings, and users can access real-time data on trading volume and liquidity. The app also supports stablecoin transactions, making it easier to hedge against market volatility. Compared to competitors like Coinbase or the defunct FTX, Binance’s mobile platform stands out for its low fees—especially when using BNB for transactions—and its advanced charting tools powered by TradingView. Traders can leverage limit orders, stop-losses, and even futures contracts, all from their smartphones.

For those managing multiple crypto wallets, the app’s portfolio tracker is a game-changer. It aggregates holdings across networks, providing a snapshot of profits/losses and tax implications. Regional adaptations are noteworthy too: Binance China and Binance Shanghai users, for instance, get localized content and support for RMB transactions, while Binance Malta adheres to EU’s strict financial regulation policies. The app’s educational hub, championed by co-founder Yi He, offers bite-sized guides on blockchain basics and advanced strategies, helping users invest in crypto wisely. Minor drawbacks include occasional latency during peak crypto trading hours and limited customer service options—though the in-app chatbot handles most queries efficiently.

Pro tips for maximizing the app: Enable dark mode to reduce battery drain, use the “earn” section to stake idle assets for passive income, and explore the NFT marketplace for exclusive drops. Whether you’re a day trader or a long-term holder, the Binance mobile app in 2025 delivers a crypto exchange experience that balances innovation with user safety. Just remember to update the app regularly—new features like AI-powered trade suggestions and enhanced regulatory compliance checks are rolled out frequently.

Professional illustration about Binance

Binance Staking Rewards Guide

Binance Staking Rewards Guide

Staking on Binance is one of the most efficient ways to earn passive income in the crypto market, especially if you're holding assets like BNB, Ethereum, or other supported digital assets. Unlike traditional trading, staking allows you to lock up your coins to support blockchain operations while earning rewards—often with higher APYs than savings accounts. Whether you're using Binance.US, Binance Japan, or the global platform, the process is streamlined for both beginners and experienced investors.

How Binance Staking Works

Binance offers flexible and locked staking options. Flexible staking lets you unstake anytime, making it ideal for traders who need liquidity. Locked staking, on the other hand, provides higher rewards but requires you to commit your coins for a fixed term (e.g., 30, 60, or 90 days). For example, staking BNB on Binance can yield up to 5% APY, while Ethereum staking rewards vary based on network demand. The platform also supports stablecoins like USDT and USDC, offering lower-risk options for conservative investors.

Key Factors Affecting Staking Rewards

- Trading Volume & Demand: High demand for staking can reduce rewards, while lower participation may increase APYs.

- Regulatory Compliance: Changes in financial regulation, such as those affecting Binance Bermuda or Binance Malta, can impact staking availability.

- Market Conditions: Bull markets often see higher staking rewards due to increased network activity.

Comparing Binance to Competitors

While Coinbase and FTX (before its collapse) also offered staking, Binance stands out due to its wider selection of supported coins and competitive rates. Under leaders like Changpeng Zhao (CZ) and Richard Teng, Binance has prioritized user-friendly staking interfaces and transparent reward structures. However, always check regional restrictions—for instance, Binance China and Binance Shanghai operate under different rules due to local regulatory compliance requirements.

Maximizing Your Staking Strategy

To get the most out of Binance staking:

1. Diversify: Spread your stakes across multiple assets (e.g., Bitcoin-backed tokens, BNB, and stablecoins) to balance risk.

2. Monitor Lock Periods: Align locked staking terms with your crypto trading goals to avoid missing market opportunities.

3. Stay Updated: Follow Binance announcements, as new staking opportunities (like those for Binance Japan-exclusive coins) often arise.

Risks to Consider

Despite its benefits, staking isn’t risk-free. Money laundering crackdowns or sudden financial regulation shifts could freeze assets temporarily. Additionally, crypto wallet security is crucial—always enable two-factor authentication (2FA) to protect your staked funds.

Whether you're looking to invest in crypto long-term or simply grow your holdings, Binance staking provides a versatile tool for earning rewards. Just remember to research each asset’s staking mechanics and stay informed about platform updates to optimize your returns.

Professional illustration about Binance

Binance NFT Marketplace Update

Binance NFT Marketplace Update

The Binance NFT Marketplace continues to evolve in 2025, solidifying its position as a leading platform for trading digital assets in the crypto market. With Binance expanding its global footprint—including operations in Binance.US, Binance Bermuda, and Binance Japan—the NFT marketplace has seen significant upgrades to enhance user experience, regulatory compliance, and trading volume. One of the most notable changes is the integration of BNB as the primary currency for transactions, offering users reduced fees and faster settlements compared to other cryptocurrencies like Bitcoin or Ethereum.

Under the leadership of Richard Teng, who succeeded Changpeng Zhao, Binance has doubled down on financial regulation and regulatory compliance, addressing past concerns about money laundering and operational transparency. The platform now requires stricter KYC (Know Your Customer) verification for high-value NFT trades, aligning with global standards. Additionally, Binance NFT has introduced a new feature called "Buy Crypto with Fiat", allowing users to purchase stablecoins or BNB directly within the marketplace, streamlining the process for newcomers to invest in crypto.

For collectors and traders, the marketplace has expanded its offerings beyond art and collectibles to include utility-based NFTs, such as access tokens for exclusive events or decentralized applications (dApps). The trading interface has also been optimized for mobile users, with improved filters for rarity, price range, and creator reputation. Yi He, co-founder of Binance, emphasized in a recent statement that the platform aims to bridge traditional and blockchain-based asset trading, making NFTs more accessible to mainstream audiences.

Competitors like Coinbase and the revived FTX have been playing catch-up, but Binance’s aggressive adoption of multi-chain support (including Ethereum Virtual Machine-compatible networks) gives it an edge. The marketplace now supports NFTs minted on Binance’s own BSC (Binance Smart Chain), as well as Ethereum, Polygon, and Solana, catering to a broader crypto trading community.

For those looking to dive into Binance NFT, here are a few actionable tips:

- Leverage BNB for lower fees: Paying gas fees in BNB can save up to 25% compared to other cryptocurrencies.

- Explore new categories: Utility NFTs, such as gaming assets or subscription passes, are gaining traction.

- Stay compliant: Ensure your crypto wallet and identity verification are up to date to avoid trading restrictions.

The Binance NFT Marketplace is more than just a hub for digital art—it’s a dynamic ecosystem reflecting the rapid innovation in the crypto exchange space. Whether you’re a seasoned trader or a beginner, keeping an eye on its updates can unlock new opportunities in the ever-expanding world of digital assets.

Professional illustration about Binance

Binance Futures Trading Tips

Binance Futures Trading Tips: Strategies for Maximizing Profits in 2025

Trading futures on Binance can be highly lucrative, but it requires a solid strategy to navigate the volatile crypto market. Whether you're trading Bitcoin, Ethereum, or altcoins paired with BNB, these tips will help you optimize your trades while staying compliant with financial regulations.

One of the biggest advantages of Binance Futures is leverage, but it’s also a double-edged sword. While 10x or even 50x leverage can amplify gains, it can also lead to significant losses. Always set stop-loss orders to protect your capital. For example, if you're trading Ethereum with 20x leverage, a 5% price drop could wipe out your position—so calculate your risk tolerance before entering a trade.

With Binance.US, Binance Bermuda, and other regional entities adapting to local financial regulations, staying informed is crucial. For instance, Binance Japan and Binance Malta have different compliance requirements, which could impact trading conditions. Follow updates from Changpeng Zhao (CZ), Yi He, or Richard Teng to ensure your strategies align with the latest policies.

Stablecoins like USDT or USDC can be lifesavers during extreme market swings. If you’re holding a long position in Bitcoin but anticipate short-term downside, converting a portion of your holdings to a stablecoin can reduce exposure. This tactic is especially useful when trading on Binance Shanghai or other platforms where local market sentiment drives price action.

High trading volume usually means better liquidity and tighter spreads. Before opening a futures position, check the order book depth for your chosen pair (e.g., BTC/USDT or ETH/BNB). Thin markets can lead to slippage, so stick to major pairs unless you’re confident in your analysis.

While Binance dominates the crypto trading landscape, diversifying across platforms like Coinbase or FTX (if operational) can provide arbitrage opportunities. For example, price discrepancies between Binance China and other exchanges might allow for profitable spreads.

The crypto market doesn’t operate in a vacuum—global economic shifts, regulatory compliance updates, and even geopolitical events can impact prices. Follow blockchain news, money laundering crackdowns, and institutional adoption trends to anticipate market movements.

Beyond market and limit orders, Binance Futures offers trailing stops, take-profit orders, and iceberg orders. For instance, a trailing stop can lock in profits while letting a winning trade run, ideal for volatile assets like Ethereum.

By combining these strategies with disciplined risk management, you’ll be better positioned to succeed in Binance Futures trading. Always remember: the key to long-term profitability isn’t just making gains—it’s preserving capital in unpredictable markets.

Professional illustration about Shanghai

Binance Customer Support 2025

In 2025, Binance continues to dominate the crypto exchange landscape, but its customer support remains a hot topic among traders. Whether you're dealing with Binance.US, Binance Bermuda, or other regional platforms, understanding how to navigate their support system is crucial. The exchange has invested heavily in AI-driven chatbots and 24/7 live agents to address issues like Crypto Trading disputes, Crypto Wallet recovery, and regulatory compliance concerns. For example, if you encounter withdrawal delays—a common pain point—their updated ticketing system now provides real-time updates, reducing resolution times by 40% compared to 2024.

One standout feature is Binance's dedicated compliance team, which handles queries related to financial regulation and money laundering checks. Given the increasing scrutiny from global regulators, this team ensures smoother onboarding for institutional clients. Users can also access a revamped Help Center with step-by-step guides for Buy Crypto processes, stablecoin conversions, and troubleshooting BNB transactions. Pro tip: If your issue involves high-value digital assets, escalate it via the "Priority Support" option—available to users with a 30-day trading volume exceeding $100K.

However, challenges persist. Some traders report slower responses during peak Crypto Market volatility, a reminder that even top-tier platforms face scalability hurdles. Binance has countered this by expanding regional hubs like Binance Shanghai and Binance Japan, offering localized support in native languages. For complex cases—say, recovering funds from a compromised Ethereum wallet—the platform now partners with third-party cybersecurity firms to expedite resolutions.

Bottom line? Binance's 2025 customer support is more robust but demands proactive engagement. Always document your transactions (especially with Bitcoin, where irreversible transfers are common) and use the in-app chat before resorting to email. With leaders like Changpeng Zhao and Richard Teng steering the ship, the exchange is clearly prioritizing user experience—but in the fast-paced world of blockchain, staying informed is your best defense.

Fun fact: Binance's support team now uses machine learning to predict common issues based on your trading history, often resolving them before you even file a ticket.

Professional illustration about Bitcoin

Binance Fiat Deposit Options

Binance Fiat Deposit Options in 2025: A Comprehensive Guide

When it comes to funding your Binance account, the platform offers a wide range of fiat deposit options tailored to different regions and user needs. Whether you're trading Bitcoin, Ethereum, or other digital assets, understanding how to deposit fiat currency efficiently is crucial for seamless crypto trading.

Binance operates in multiple jurisdictions, each with its own set of financial regulations and deposit methods. For example:

- Binance.US: Supports ACH transfers, wire transfers, and debit cards, making it easy for U.S. users to buy crypto with USD. Regulatory compliance is strict, so expect verification steps to prevent money laundering.

- Binance Bermuda & Malta: These EU-friendly hubs often support SEPA transfers, ideal for Euro deposits with low fees.

- Binance Japan: Accepts JPY via local bank transfers and convenience stores, catering to the unique crypto market preferences in Japan.

- Binance Shanghai (for institutional clients): Offers direct CNY deposits through partnerships with licensed intermediaries, though retail traders face tighter restrictions due to China's regulatory compliance policies.

- Bank Transfers: The most common method, often with low fees. Binance supports SWIFT, SEPA, and local rails like Faster Payments (UK) or PIX (Brazil).

- Credit/Debit Cards: Instant deposits are possible, but fees can range from 1.5% to 3%. Major cards like Visa and Mastercard are accepted globally.

- Third-Party Payment Processors: Services like Apple Pay, Google Pay, and regional providers (e.g., Pix in Brazil or PayID in Australia) streamline deposits.

Stablecoin On-Ramps: Some users prefer converting fiat to stablecoins like USDT or USDC via Binance’s "Buy Crypto" feature before trading.

Fees: Wire transfers may incur charges (up to $30), while ACH or SEPA deposits are often free. Always check Binance’s latest fee schedule.

- Processing Times: Card deposits are instant, but bank transfers can take 1-5 business days, depending on the region.

- Regulatory Hurdles: Under CEO Richard Teng, Binance has doubled down on compliance. Users in high-regulation zones (e.g., the U.S. or EU) may face additional KYC steps.

Alternatives: If direct fiat deposits aren’t available, consider peer-to-peer (P2P) trading or using a partner exchange like Coinbase to transfer crypto to Binance.

Verify your account early to avoid delays.

- Use Binance’s Crypto Wallet to track deposits and avoid sending funds to outdated addresses.

- Monitor trading volume trends—depositing during low-fee promotions can save costs.

By leveraging the right fiat deposit options, you can optimize your crypto exchange experience on Binance, whether you're a casual trader or a high-volume investor. Always stay updated with local regulations, as policies can shift rapidly in the blockchain space.

Professional illustration about Ethereum

Binance DeFi Integration 2025

Binance DeFi Integration 2025

In 2025, Binance continues to lead the charge in DeFi integration, bridging the gap between centralized and decentralized finance. The platform’s seamless BNB-powered ecosystem now supports a wider range of blockchain-based financial services, from yield farming to cross-chain swaps. With Binance.US and other regional entities like Binance Japan and Binance Bermuda adapting to local financial regulations, users globally can access DeFi protocols without compromising regulatory compliance. For example, Binance Shanghai has introduced tailored stablecoin pools for Chinese traders, while Binance Malta focuses on crypto trading innovations under EU frameworks.

One standout feature is Binance’s Buy Crypto portal, which now directly connects to DeFi platforms, allowing users to purchase Bitcoin, Ethereum, or BNB and instantly deploy them into liquidity pools or lending protocols. This integration eliminates the friction of transferring assets between wallets and exchanges, a game-changer for both beginners and seasoned crypto traders. Under CEO Richard Teng’s leadership, Binance has also prioritized security, implementing advanced money laundering detection tools to safeguard digital assets across its DeFi offerings.

The crypto market in 2025 demands interoperability, and Binance delivers. Its Crypto Wallet now natively supports cross-chain swaps between Ethereum, BNB Chain, and emerging blockchain networks, making it easier to invest in crypto across ecosystems. Competitors like Coinbase and the revived FTX are playing catch-up, but Binance’s first-mover advantage in DeFi—bolstered by co-founders Changpeng Zhao and Yi He’s vision—keeps it ahead. For traders, this means lower fees, faster transactions, and access to exclusive DeFi projects vetted by Binance’s team.

Looking ahead, Binance’s DeFi strategy hinges on scalability. The platform is piloting AI-driven trading volume analytics to optimize liquidity provision, ensuring users earn competitive yields even during market volatility. Whether you’re staking BNB or exploring niche DeFi tokens, Binance’s 2025 infrastructure makes it the go-to crypto exchange for decentralized finance.

Professional illustration about Changpeng

Binance Token Listings 2025

Binance Token Listings 2025

In 2025, Binance continues to dominate the crypto exchange landscape with its strategic token listings, offering traders access to the most promising digital assets. Under the leadership of Richard Teng, Binance has maintained its reputation for curating high-potential projects while navigating financial regulation challenges. The platform’s BNB token remains a cornerstone of its ecosystem, fueling transactions and providing utility across Binance’s global operations, including Binance.US, Binance Bermuda, and Binance Japan.

One of the standout trends in 2025 is Binance’s focus on regulatory compliance, especially after the heightened scrutiny following the FTX collapse. The exchange has prioritized partnerships with projects that demonstrate transparency and adherence to anti-money laundering (AML) standards. For example, recent listings include stablecoins backed by audited reserves and blockchain projects with clear governance frameworks. This shift aligns with global crypto trading regulations, ensuring Binance remains a trusted platform for invest in crypto activities.

The crypto market in 2025 also sees Binance expanding its listings to include tokens with real-world utility, such as those powering decentralized finance (DeFi) protocols and Web3 ecosystems. Projects like Ethereum-based Layer 2 solutions and Bitcoin-pegged assets have gained traction, reflecting investor demand for scalability and interoperability. Meanwhile, Binance China and Binance Shanghai have introduced localized listings tailored to Asian markets, featuring tokens with strong regional adoption.

For traders looking to buy crypto on Binance, the platform’s trading volume remains unmatched, providing liquidity for both established and newly listed tokens. The exchange’s Crypto Wallet integration ensures seamless asset management, while its Buy Crypto portal simplifies onboarding for beginners. Notably, Binance’s rivalry with Coinbase has intensified, with both exchanges vying for dominance in crypto trading by offering exclusive listings and lower fees.

Here’s what sets Binance’s 2025 token listings apart:

- Diverse Asset Selection: From stablecoins to niche cryptocurrency projects, Binance caters to all risk appetites.

- Regulatory-First Approach: Listings now require rigorous compliance checks, reducing the risk of scams or regulatory backlash.

- Regional Focus: Tokens listed on Binance Malta or Binance Japan often reflect local regulatory frameworks and market demand.

The leadership of Changpeng Zhao and Yi He continues to influence Binance’s listing strategy, emphasizing innovation and user security. As the crypto exchange evolves, Binance’s 2025 token listings serve as a benchmark for the industry, combining market relevance with regulatory diligence. Whether you’re a seasoned trader or new to crypto trading, Binance’s curated selections offer a gateway to the most dynamic digital assets of the year.

Professional illustration about Yi

Binance vs Competitors 2025

Binance vs Competitors 2025: How the Crypto Exchange Stacks Up in a Crowded Market

As the crypto exchange landscape evolves in 2025, Binance remains a dominant player, but competitors like Coinbase and the revamped FTX are closing the gap. The platform's strengths—such as its massive trading volume, diverse digital assets, and the utility of BNB—continue to attract traders. However, regulatory challenges, including financial regulation and money laundering scrutiny, have forced Binance to adapt, with regional entities like Binance.US, Binance Japan, and Binance Bermuda operating under stricter regulatory compliance. Meanwhile, Coinbase has leveraged its reputation for transparency to gain institutional trust, while FTX, under new leadership, is aggressively expanding its crypto trading features.

One of Binance's key advantages is its ecosystem. The BNB token, originally launched as a utility token, now powers everything from transaction fee discounts to decentralized applications on the blockchain. Competitors struggle to match this level of integration, though Coinbase has made strides with its own stablecoin offerings and user-friendly Crypto Wallet. Meanwhile, FTX is betting on derivatives and leveraged trading, appealing to high-risk traders.

Geopolitical factors also play a role. While Binance China and Binance Shanghai face heavy restrictions due to local financial regulation, Binance Malta and Binance Bermuda benefit from more crypto-friendly policies. This fragmented approach allows Binance to remain agile, but it also creates inconsistencies in user experience. In contrast, Coinbase maintains a unified global platform, simplifying Buy Crypto processes for beginners.

Leadership changes have also shaped the competitive landscape. After Changpeng Zhao stepped down, Richard Teng and Yi He have steered Binance toward greater compliance, but some users worry this could dilute its edge in crypto trading innovation. Meanwhile, FTX’s resurgence under new management highlights how quickly the Crypto Market can shift.

For traders deciding where to Invest in Crypto, the choice depends on priorities. Binance excels in variety and low fees, Coinbase wins on security and ease of use, and FTX caters to advanced traders. As digital assets become mainstream, regulatory clarity will likely determine which exchange comes out on top.

Professional illustration about Richard

Binance Tax Reporting Tools

Binance Tax Reporting Tools: Simplify Your Crypto Tax Compliance in 2025

Navigating cryptocurrency taxes can be a headache, but Binance’s suite of tax reporting tools is designed to streamline the process for traders and investors. Whether you’re using Binance.US, Binance Japan, or another regional platform, these tools automatically aggregate your crypto trading activity—including trades involving Bitcoin, Ethereum, and BNB—and generate tax-ready reports. For U.S. users, Binance.US integrates with popular tax software like TurboTax and CoinTracker, ensuring compliance with IRS guidelines. Meanwhile, global users can leverage Binance Bermuda or Binance Malta’s reporting features to meet local regulatory requirements, such as the EU’s financial regulation standards.

One standout feature is the ability to categorize transactions by type (e.g., Buy Crypto, staking rewards, or stablecoin conversions) and export them as CSV or PDF files. This is particularly useful for active traders with high trading volume, as it eliminates manual data entry errors. For example, if you’ve traded Ethereum for Bitcoin multiple times in 2025, the tool will calculate capital gains/losses for each transaction based on your cost basis. Binance also supports regulatory compliance by flagging suspicious activity to prevent money laundering, a feature emphasized under CEO Richard Teng’s leadership following Changpeng Zhao’s departure.

Here’s how to maximize Binance’s tax tools:

- Review your transaction history quarterly: Spot discrepancies early, especially if you trade across multiple platforms like Coinbase or FTX (for legacy transactions).

- Use the “Tax Summary” dashboard: It breaks down your digital assets by gains, losses, and income (e.g., from Crypto Wallet staking).

- Cross-check with local laws: Regulations vary—for instance, Binance China users face stricter reporting than those on Binance Shanghai due to regional policies.

For institutional clients, Binance offers advanced APIs to sync data with accounting systems, a boon for firms managing large crypto market exposures. As Yi He, Binance’s co-founder, noted in a 2025 interview, the platform’s focus on blockchain transparency aligns with global trends toward automated tax solutions. Pro tip: If you’re new to investing in crypto, start with Binance’s tutorial on interpreting tax forms like Form 8949 (U.S.) or its international equivalents.

While no tool can replace professional tax advice, Binance’s features significantly reduce the friction of crypto tax reporting. Just remember—the key to avoiding audits is consistency. Whether you’re a casual hodler or a high-frequency trader, documenting every crypto exchange transaction is non-negotiable in 2025’s tightly regulated landscape.

Professional illustration about Coinbase

Binance Smart Chain Updates

Binance Smart Chain Updates for 2025: What Traders and Developers Need to Know

The Binance Smart Chain (BSC) continues to evolve as a powerhouse in the blockchain space, offering faster transactions and lower fees compared to networks like Ethereum. In 2025, Binance has rolled out critical upgrades to enhance scalability, security, and regulatory compliance—key areas for crypto trading and decentralized application (dApp) development. One major update includes the integration of zk-Rollups, significantly boosting throughput while maintaining low gas fees. This positions BSC as a top choice for invest in crypto enthusiasts seeking cost-efficient alternatives.

Under the leadership of Richard Teng, Binance has also prioritized regulatory compliance, particularly for subsidiaries like Binance.US, Binance Japan, and Binance Bermuda. New financial regulation measures include stricter KYC (Know Your Customer) protocols and enhanced money laundering safeguards. For example, BNB token transactions now require additional identity verification steps for large volumes, aligning with global standards. These changes aim to foster trust among institutional investors and mitigate risks associated with digital assets.

For developers, the 2025 BSC upgrade introduces Ethereum Virtual Machine (EVM) compatibility enhancements, making it easier to port Ethereum-based dApps to Binance Smart Chain. Tools like the updated Crypto Wallet SDK and optimized smart contract libraries simplify deployment. A standout feature is the new stablecoin bridge, allowing seamless swaps between BUSD, USDT, and other dollar-pegged tokens across chains. Traders leveraging Buy Crypto options on Binance can now execute cross-chain swaps with minimal slippage—a game-changer for arbitrage strategies.

Market Impact and Competitive Edge

The 2025 updates solidify BSC's position against rivals like Coinbase's Base chain and the defunct FTX ecosystem. Trading volume on BSC has surged by 35% year-over-year, partly due to its high-yield staking rewards for BNB holders. Additionally, Binance Shanghai's R&D team has introduced AI-powered fraud detection tools, reducing scam token listings by 60%. This proactive approach contrasts sharply with past criticisms of lax monitoring in the crypto exchange sector.

For retail users, Binance Smart Chain now supports one-click Crypto Market analytics directly in its interface, featuring real-time data on top-performing dApps and tokens. Partnerships with Binance Malta and Binance China have expanded fiat onboarding options, enabling users in regulated markets to fund accounts via localized payment methods. Meanwhile, Changpeng Zhao's vision of a decentralized crypto trading ecosystem remains central, with governance proposals now allowing BNB holders to vote on chain parameter adjustments.

Key Takeaways for 2025

- Scalability: zk-Rollups and sharding tests promise 10,000+ TPS, addressing congestion during peak Crypto Trading periods.

- Security: Multi-signature smart contracts and audits by Yi He-led teams ensure safer dApp interactions.

- Compliance: Geo-fenced services for Binance.US and other regions prevent regulatory clashes.

- Innovation: Native support for Bitcoin-wrapped assets (BTCB) bridges BSC with the Bitcoin network, expanding DeFi use cases.

Whether you're a trader, developer, or long-term holder, these Binance Smart Chain updates offer tangible advantages in speed, cost, and accessibility—critical factors in the fast-moving cryptocurrency landscape.

Professional illustration about FTX

Binance Regulatory Compliance 2025

Binance Regulatory Compliance 2025

In 2025, Binance continues to navigate the evolving landscape of financial regulation, reinforcing its commitment to regulatory compliance across global markets. Under the leadership of Richard Teng, who took over after Changpeng Zhao, the exchange has implemented stricter anti-money laundering (AML) protocols and enhanced transparency measures. For instance, Binance.US now adheres to the U.S. Securities and Exchange Commission (SEC) guidelines, requiring detailed KYC (Know Your Customer) verification for all users trading Bitcoin, Ethereum, and other digital assets. This shift aligns with competitors like Coinbase, which has set a high bar for compliance in the crypto exchange space.

One of the biggest challenges for Binance in 2025 is harmonizing its operations across jurisdictions. While Binance Bermuda and Binance Malta benefit from crypto-friendly regulations, Binance Japan faces stricter oversight from the Financial Services Agency (FSA), particularly around stablecoin issuance and crypto trading volumes. Meanwhile, Binance China operates under heavy restrictions, focusing solely on blockchain research rather than exchange services due to the country’s ban on cryptocurrency trading. Yi He, co-founder of Binance, has emphasized the importance of localization, ensuring each regional entity, including Binance Shanghai, complies with local laws while maintaining the platform’s global standards.

To stay ahead, Binance has invested heavily in compliance technology. Its proprietary blockchain analytics tools now monitor suspicious transactions in real-time, reducing risks associated with money laundering. The exchange also collaborates with regulators to develop industry-wide frameworks, such as the Crypto Market Integrity Initiative, which promotes fair trading practices. Users looking to invest in crypto can also leverage Binance’s updated Crypto Wallet, which integrates biometric authentication for added security.

Here’s what traders should know about Binance’s 2025 compliance strategy:

- Enhanced KYC/AML: Mandatory identity verification for high-volume traders, including those trading BNB or using Buy Crypto features.

- Regional Adaptability: Tailored services for markets like Japan and Bermuda, where regulations differ significantly.

- Transparency Reports: Quarterly disclosures on trading volumes, token listings, and regulatory engagements.

- Stablecoin Oversight: Close monitoring of stablecoin reserves to prevent liquidity crises, a lesson learned from the FTX collapse.

While Binance’s efforts are commendable, critics argue that the exchange still faces scrutiny, particularly around its historical lack of transparency. However, with Richard Teng at the helm, Binance appears more focused than ever on building trust with regulators and users alike. Whether you’re a casual trader or a high-net-worth investor, understanding these compliance measures is crucial for navigating the Crypto Trading landscape in 2025.